Budgeting can feel overwhelming. It is easy to forget the big picture when you are focused on the numbers. That’s where a budget binder comes in. This simple tool keeps everything in one place, making staying on top of your finances easier. Whether you’re trying to save money, pay off debt, or just get organized, a budget binder can help. Creating a budget binder doesn’t have to be complicated. The goal is to make something that works for you. Think of it as a personalized system, tailored to your financial goals and needs. In this post, I’ll share some practical budget binder ideas to help you get started.

This site includes affiliate links; you can check the disclosure for more details.

Ideas for Setting Up Your Budget Binder

Using a binder might feel a bit old-fashioned with all the apps and spreadsheets out there. But there’s something satisfying about physically writing things down. It helps you feel more connected to your goals. Plus, it’s easy to customize a binder to fit your life.

The first step in setting up a budget binder is choosing the right materials. Here’s what you’ll need:

- A sturdy three-ring binder (one-inch rings work for most people).

- Dividers or tabs to organize your sections.

- Paper for tracking your finances.

- Page protectors for important documents.

Next, think about how to organize your binder. Dividers make it easy to flip to the section you need. Some common sections include:

- Income: Track all your money coming in.

- Expenses: List everything you spend, from bills to groceries.

- Savings: Set goals and track your progress.

- Debt: Monitor balances and payments.

- Goals: Write down short-term and long-term financial goals.

One of my favorite budget binder ideas is using different colored dividers for each section. It adds a pop of color and makes the binder more visually appealing. Label each section with simple tabs or stickers to keep it easy to use. The simpler the setup, the more likely you’ll stick with it.

Tracking Income and Expenses

The heart of any budget is knowing where your money is coming from and where it’s going. That’s why the income and expenses sections are so important. In your budget binder, these should be the first sections you create.

For income, list all sources of money you receive each month. This could include your paycheck, side gigs, child support, or any other income streams. It’s helpful to have a running total of your monthly income so you can see exactly how much you have to work with.

When it comes to expenses, be as detailed as possible. Write down everything you spend money on, from bills to groceries to entertainment. Some people like to separate fixed expenses (like rent or mortgage payments) from variable expenses (like groceries or gas). This helps you see which areas you have more control over.

Another one of my budget binder ideas is to use a simple table or chart to track your expenses. This way, you can easily compare what you planned to spend with what you actually spent. It’s a quick and easy way to spot trends and areas where you might need to cut back.

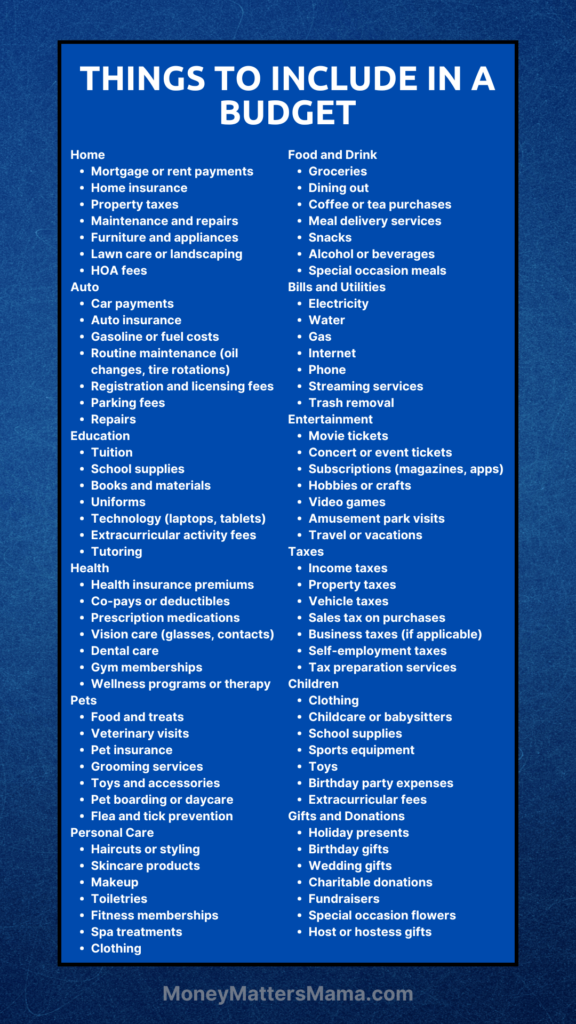

Typical Expenses in a Budget

Home

- Mortgage or rent payments

- Home insurance

- Property taxes

- Maintenance and repairs

- Furniture and appliances

- Lawn care or landscaping

- HOA fees

Auto

- Car payments

- Auto insurance

- Gasoline or fuel costs

- Routine maintenance (oil changes, tire rotations)

- Registration and licensing fees

- Parking fees

- Repairs

Education

- Tuition

- School supplies

- Books and materials

- Uniforms

- Technology (laptops, tablets)

- Extracurricular activity fees

- Tutoring

Health

- Health insurance premiums

- Co-pays or deductibles

- Prescription medications

- Vision care (glasses, contacts)

- Dental care

- Gym memberships

- Wellness programs or therapy

Pets

- Food and treats

- Veterinary visits

- Pet insurance

- Grooming services

- Toys and accessories

- Pet boarding or daycare

- Flea and tick prevention

Personal Care

- Haircuts or styling

- Skincare products

- Makeup

- Toiletries

- Fitness memberships

- Spa treatments

- Clothing

Food and Drink

- Groceries

- Dining out

- Coffee or tea purchases

- Meal delivery services

- Snacks

- Alcohol or beverages

- Special occasion meals

Bills and Utilities

- Electricity

- Water

- Gas

- Internet

- Phone

- Streaming services

- Trash removal

Entertainment

- Movie tickets

- Concert or event tickets

- Subscriptions (magazines, apps)

- Hobbies or crafts

- Video games

- Amusement park visits

- Travel or vacations

Taxes

- Income taxes

- Property taxes

- Vehicle taxes

- Sales tax on purchases

- Business taxes (if applicable)

- Self-employment taxes

- Tax preparation services

Children

- Clothing

- Childcare or babysitters

- School supplies

- Sports equipment

- Toys

- Birthday party expenses

- Extracurricular fees

Gifts and Donations

- Holiday presents

- Birthday gifts

- Wedding gifts

- Charitable donations

- Fundraisers

- Special occasion flowers

- Host or hostess gifts

Setting and Tracking Financial Goals

No budget binder would be complete without a section for financial goals. This is where you write down what you want to achieve with your money. Whether it’s saving for a vacation, paying off credit card debt, or building an emergency fund, your goals should be specific and realistic.

A good practice is to break down your goals into smaller, manageable steps. For example, if your goal is to save $1,000 for an emergency fund, decide how much you need to save each month to reach that goal in a certain timeframe. Then, track your progress in your budget binder.

One of the most motivating budget binder ideas is to include a visual tracker for your goals. You can create a simple chart or graph to fill in as you make progress. Seeing your savings grow or your debt shrink can be incredibly rewarding and keeps you motivated.

Monthy Pages Can Be Edited Here

Managing Debt Effectively

Debt can be a major stressor, but it doesn’t have to be. A budget binder can help you take control of your debt by keeping everything organized. Start by listing all of your debts. Include the following details:

- Total balance

- Interest rate

- Minimum payment

- Due date

This information should go in its own section of your binder. Having everything in one place makes it easier to develop a clear plan. Next, decide how you want to approach paying off your debts. Some people use the snowball method, starting with the smallest debt for quick wins. Others prefer the avalanche method, focusing on the debt with the highest interest rate to save money over time. Pick the method that feels right for you.

Once your plan is in place, track your progress. One of the best budget binder ideas is creating a debt payoff tracker. Here are a few ways you can do this:

- Use a simple table to list payments made.

- Create a visual chart or graph that you update as balances shrink.

- Make a coloring sheet, like a thermometer, where you fill in sections as debts are paid off.

Seeing your progress, even small steps, can be incredibly motivating. As you update your binder, celebrate milestones. Paying off one debt, no matter how small, is an achievement worth recognizing.

Consistency is key. Regularly updating your binder keeps your goals front and center. Over time, you’ll see those balances go down and feel more in control of your financial future.

Tracking Savings: Budget Binder Ideas

Saving money is an essential part of any budget. Whether you’re building an emergency fund, saving for a big purchase, or simply putting some money aside for the future, tracking your savings helps you stay focused. Your budget binder is the perfect place to organize your savings goals and progress.

Start by creating a section just for savings. Use this section to track the money you’re setting aside each month. Here are some ideas for what to include:

- Savings goal descriptions (like an emergency fund or vacation fund)

- Total savings targets for each goal

- Monthly contribution amounts

- A running total of your savings progress

- Space for notes about adjustments or unexpected contributions

You can dedicate a separate page to each savings goal or keep everything on one page for simplicity. The key is updating it regularly to see your progress in real time.

One of the most motivating budget binder ideas is to incorporate a savings challenge. This adds a little excitement to your budgeting routine. For example:

- Weekly Savings Challenge: Save a set amount each week, like $10, and watch it grow.

- No-Spend Challenge: Skip unnecessary purchases for a week or month, then transfer the money you didn’t spend into savings.

- Goal-Specific Challenge: Focus on saving for one specific item, like holiday gifts or a new appliance.

Use your binder to track each challenge and celebrate when you hit a milestone. Consider adding a visual tracker, like a coloring sheet or progress bar, to make it more fun.

Staying consistent with your savings plan builds confidence and gets you closer to your goals. Your budget binder makes it easy to stay on track and motivated.

Planning for the Future

A budget binder isn’t just about managing your money now; it’s also about planning for the future. This could include retirement savings, college funds for your kids, or even just planning next year’s vacation. Whatever your long-term goals are, your budget binder can help you stay on track.

In this section, write down your future goals and the steps you need to take to achieve them. It might feel overwhelming at first, but breaking it down into smaller tasks can make it more manageable.

For example, if your goal is to save for retirement, start by figuring out how much you need to save each month. Then, track your contributions in your binder. This will help you stay focused and make adjustments as needed.

One of the best budget binder ideas is to review this section regularly. Life changes, and so do your goals. By keeping this section up-to-date, you can ensure that your budget binder continues to reflect your priorities and helps you plan for a secure financial future.

Staying Motivated and Consistent

Consistency is key when it comes to budgeting, but let’s be honest—it’s not always easy. It’s common to start strong, only to lose steam after a few months. That’s where your budget binder can really shine. By keeping everything organized and in one place, you’ll have a tool that helps you stay on track, even when life gets hectic.

To make budgeting a habit, set aside a specific time each week to update your binder. Think of it as your “budget check-in.” Spend 10 or 15 minutes reviewing your finances, tracking expenses, and planning for the upcoming week. When it’s in your routine, it feels easier and becomes second nature.

Adding some creativity to the process can also keep things fun and engaging. Use colorful pens, highlighters, or even stickers to brighten up your binder. Decorate your pages or add inspirational quotes to keep you motivated. One of my favorite budget binder ideas is to use a reward system. When you hit a milestone, like saving a set amount or paying off a bill, treat yourself to something small—maybe a favorite snack or a new pen for your binder.

Don’t forget to be kind to yourself if you hit a rough patch. Budgeting is a skill that takes time to master. Life happens, and it’s okay to adjust your plans when needed. The important thing is to keep going. Every small step forward gets you closer to your goals.

Your budget binder is more than a tool; it’s a guide to help you manage your finances with less stress. Stick with it, and you’ll build a habit that makes budgeting feel like second nature.

Final Thoughts on Budget Binder Ideas

A budget binder is more than just a tool—it’s a way to take control of your finances and stay on track with your goals. By keeping everything organized and in one place, you’re setting yourself up for success. The beauty of a budget binder is how customizable it is. No two binders need to look the same. It’s all about making it work for you and your unique life.

Think of your budget binder as your personal financial assistant. It doesn’t have to be fancy. What matters most is that it helps you stay focused on what’s important: tracking your income, monitoring expenses, and planning for the future. You’re creating a system that gives you clarity and confidence about your money.

It’s also important to remember that budgeting isn’t about perfection. We all have unexpected expenses or months that don’t go as planned. What counts is being consistent and getting back on track when things go off course. Progress is the goal—not perfection.

Here are a few tips to help you stick with your budget binder:

- Set a regular time each week to update it.

- Use visuals like charts, graphs, or trackers to see your progress.

- Celebrate small wins, like paying off a bill or hitting a savings milestone.

- Keep it simple. Overcomplicating the process can make it harder to stick with.

With these budget binder ideas, you have everything you need to build a system that fits your goals and lifestyle. The hardest part is starting, but once you see the benefits, you’ll wonder how you ever managed without it. Take that first step today and watch how much more in control of your finances you feel.