Budgeting can feel overwhelming, but trust me, it doesn’t have to be. It’s not about making life harder—it’s about making your money work for you. When you have clear budget categories, you know exactly where your money is going. No more guessing. No more wondering why there’s nothing left at the end of the month.

Think of your budget like a shopping list. You wouldn’t go to the store without a plan, right? The same idea applies here. If you know what you need to cover—like housing, food, savings, and even fun—you’re less likely to overspend. And let’s be real, it’s way easier to stick to a budget when you’re not depriving yourself of everything you enjoy.

In this post, I’m breaking down everything you need to know about budget categories, including:

- How to create budget categories that actually work—because no two budgets are the same.

- Common budget mistakes—and how to fix them so your budget actually helps, not stresses you out.

- Hidden expenses to plan for—because forgetting about things like car repairs or holiday shopping can throw off your whole budget.

- How to adjust when life changes—because budgets aren’t one-size-fits-all forever.

By the time you’re done reading, you’ll have a budget that makes sense for your life. Whether you’re saving for a big goal, trying to pay off debt, or just want to stop feeling broke before payday, these budget categories will help.

And if you love finding money-saving ideas on Pinterest, you’ll want to pin this for later—because budgeting gets way easier when you’ve got a simple plan in place!

This site includes affiliate links; you can check the disclosure for more details.

Understanding the Basics of Budget Categories

Budget categories are just a simple way to organize your money. Think of them like labeled envelopes. Each one holds a different type of expense—rent, groceries, savings, and so on. When you sort your money into these categories, it’s easier to see where it’s going and make sure you have enough for what matters most.

Everyone’s budget categories will look a little different. A college student’s budget won’t include daycare, and a homeowner’s budget won’t include rent. That’s why it’s important to build a system that fits your life. Here’s how to get started:

- List your fixed expenses. These are the things you pay every month, no matter what. Think rent, mortgage, car payments, insurance, and internet.

- Write down your variable expenses. These change from month to month. Groceries, gas, utilities, and dining out all fall into this group.

- Don’t forget savings. Emergency fund, retirement, or a future big purchase—these deserve a spot in your budget. Even small contributions add up.

- Think about the extras. Things like gifts, travel, and hobbies can sneak up on you. Adding a category for them helps avoid last-minute stress.

- Adjust as needed. If you’re spending too much in one category or not enough in another, tweak your budget until it works for you.

The goal isn’t to restrict you—it’s to give your money a plan. Once you know what budget categories you need, you can start tracking your spending and making smarter financial choices.

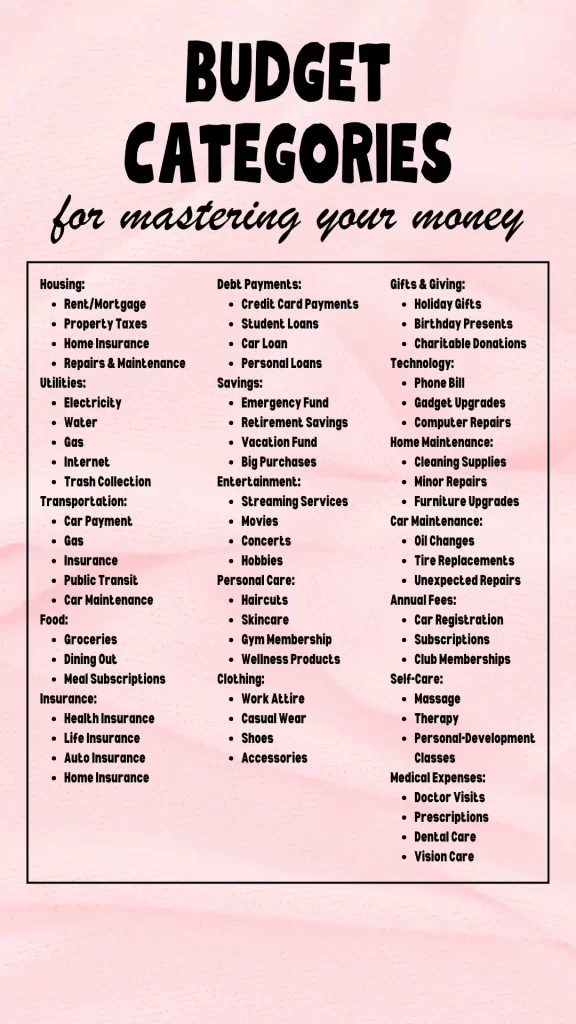

Essential Budget Categories to Consider

Let’s start with the basics. These are the categories that most people need in their budgets. They cover the essentials—those things you can’t live without.

Housing

Housing is usually the biggest expense in a budget. It includes your rent or mortgage payment, property taxes, and home insurance. For renters, this might be a single line item, but homeowners should also consider maintenance and repair costs.

When setting up your housing budget, aim to keep it around 25-30% of your income. This percentage can vary depending on where you live, but it’s a good rule of thumb to ensure you’re not overspending on housing.

Utilities

Utilities cover the basic services you need to run your home. This category includes electricity, water, gas, internet, and trash removal. It can also include other recurring bills like your cell phone or cable TV.

These costs can fluctuate throughout the year, especially with heating or cooling needs, so it’s wise to budget a bit more than your average bill to cover any unexpected spikes.

Transportation

Transportation includes any cost related to getting around. This might be your car payment, gas, insurance, and maintenance. If you use public transit, include your monthly pass or tickets here.

Transportation costs can vary widely depending on where you live and your lifestyle. If you live in a city with great public transportation, you might save a lot compared to someone who commutes by car every day.

Food

Food is another essential category. It includes your grocery bills and any dining out expenses. Eating is a non-negotiable, but you have control over how much you spend in this category. Planning meals and cooking at home can help you save money here.

If you notice you’re spending a lot on takeout or dining out, try setting a smaller budget for those and challenging yourself to stick to it.

Insurance

Insurance is a broad category that includes health, life, auto, and any other types of insurance you need. These are critical because they protect you from unexpected financial hits.

It’s easy to forget about insurance until you need it, but making sure you’re properly covered is a key part of a healthy budget. Review your policies regularly to ensure you’re not overpaying or underinsured.

Debt Payments

If you have loans or credit card debt, this part is really important. Your debt payments should be a priority in your budget. Whether it’s student loans, a car loan, or credit card payments, allocating a specific amount each month will help you pay it down faster.

Try to pay more than the minimum payment if you can. This will help you get out of debt quicker and save on interest.

Savings

Savings is a category that often gets overlooked, but it’s one of the most important. This includes your emergency fund, retirement savings, and any other savings goals you have.

An emergency fund should be a top priority. Aim to save at least three to six months’ worth of living expenses. For retirement, consider contributing to a 401(k) or IRA. Regularly setting aside money for savings will give you peace of mind and financial security.

Discretionary Budget Categories

After covering the essentials, it’s time to think about the things that make life enjoyable. These are your discretionary budget categories. They’re not necessary for survival, but they add to your quality of life.

Entertainment

Entertainment covers anything you spend on having fun. This could be movies, concerts, hobbies, or subscriptions like Netflix. It’s important to have fun, but setting a budget here can help you avoid overspending.

It’s simple to go overboard here, so pick an amount that works for you and stick with it. If you find yourself going over, consider free or low-cost entertainment options.

Personal Care

Personal care includes grooming, haircuts, skincare, and any other products or services that help you feel your best. This category might also include gym memberships or fitness classes.

Taking care of yourself is important, but it doesn’t have to be expensive. Look for ways to cut costs without sacrificing your well-being. Maybe try doing your nails at home or finding a more affordable gym.

Clothing

Clothing is another discretionary category. You need clothes, but you decide how much to spend. Some people might need more in this category, especially if their job requires a specific wardrobe. Others might be able to get by with a smaller budget.

To keep spending in check, try shopping sales, buying second-hand, or setting a clothing allowance. This way, you won’t be tempted to splurge on unnecessary items.

Gifts and Giving

This category covers any gifts you give throughout the year, whether for birthdays, holidays, or special occasions. It also includes any charitable donations you make.

Gifts and giving are important parts of life, but they can add up quickly. Setting a budget for this category will help you plan for these expenses and avoid last-minute spending sprees.

How to Adjust as Needed

A budget isn’t a one-and-done thing. Life changes, and so do expenses. If you find yourself constantly overspending in one category or forgetting to budget for something important, it’s time to adjust. A budget should work for you, not stress you out.

Here’s how to tweak your budget categories to fit your life better:

- Check your spending habits. If you’re always going over in one category—like groceries or gas—see if it’s because prices have gone up or if you need to cut back somewhere else.

- Make room for new expenses. Got a new pet? Started a gym membership? Life changes, and your budget should, too. Create a category for anything that’s now a regular part of your spending.

- Cut back on things you don’t use. Still paying for that streaming service you never watch? Have a subscription box that’s more ‘meh’ than ‘must-have’? Canceling small, unused expenses can free up money for things that actually matter.

- Celebrate when you pay off debt. If you’ve finished paying off a loan, don’t let that money just disappear into daily expenses. Shift it toward savings, investments, or another financial goal.

- Keep an eye on seasonal changes. Some expenses go up and down depending on the time of year. You might spend more on utilities in summer and winter but less in the fall and spring. Adjust your budget accordingly.

Revisiting your budget categories every few months helps keep your money working the way you want it to. The goal isn’t perfection—it’s progress!

How to Create Budget Categories That Actually Work

If you’ve ever made a budget and then ignored it completely, you’re not alone. A budget is only helpful if it actually works for your life. The trick? Creating budget categories that are realistic and easy to follow.

Here’s how to build budget categories that fit your lifestyle:

- Start with the must-haves. Think of things you absolutely can’t skip—housing, food, utilities, and transportation. These are the top priorities, so make sure they have a place in your budget.

- Be honest about your spending. If you love takeout or get a coffee every morning, don’t pretend you won’t spend money on it. Instead, add a dining-out category so it’s planned for.

- Make it personal. Your budget categories should match your life. Have kids? You’ll need a category for child-related expenses. Love to travel? Add a travel fund. The goal is to create a budget that feels natural, not restrictive.

- Leave space for fun. A budget isn’t just about bills and savings. Adding a category for hobbies, entertainment, or self-care will keep you from feeling deprived.

- Create a ‘whoops’ fund. Unexpected expenses pop up all the time. Whether it’s a last-minute school expense, a broken appliance, or a vet bill, having a catch-all category for these surprises can keep your budget from falling apart.

Your budget categories don’t have to look like anyone else’s. The best budget is one that helps you manage your money while still enjoying life. Once you’ve got categories that make sense for you, sticking to your budget becomes way easier!

Common Mistakes and How to Fix Them

Budgeting sounds simple—just list your expenses and stick to them, right? But real life doesn’t always work that way. If your budget feels like a constant struggle, you might be making one of these common mistakes with your budget categories.

- Forgetting irregular expenses. Birthdays, holidays, back-to-school shopping, and car maintenance don’t happen every month, but they do happen. If you don’t budget for them, they’ll sneak up on you.

- Being too strict. A budget isn’t about punishing yourself. If you cut out every fun expense, you’re more likely to give up. Instead, build in a little spending money so you don’t feel deprived.

- Not tracking spending. You might think you’re only spending $200 on groceries, but if you’re not keeping track, it could be way more. A budgeting app or simple spreadsheet can help keep things in check.

- Ignoring small expenses. That $5 coffee here, a $10 lunch there—it all adds up. If you don’t account for small purchases, they can blow your budget without you even realizing it.

- Not adjusting your budget. Life changes, and your budget should, too. A new job, a rent increase, or a growing family all mean it’s time to rework your budget categories.

If your budget feels off, don’t ditch it—fix it! Small changes can make a huge difference. Budgeting is about finding balance, not making yourself miserable. The right budget categories help you spend smart while still enjoying your life.

Budget Categories You Might Not Have Thought About

Most budgets include the basics—rent, groceries, bills. But what about the expenses that don’t fit neatly into those categories? Overlooking small but important things can throw off your entire budget. Here are a few budget categories you might not have considered but should:

- Annual fees. Some expenses don’t hit monthly, but when they do, they can be big. Think car registration, memberships, or annual subscriptions. If you plan ahead, they won’t catch you off guard.

- Technology. Phones, tablets, and computers don’t last forever. Setting aside money for repairs or upgrades can help you avoid unexpected costs when something breaks.

- Home maintenance. Even if you rent, you might need small fixes, like replacing light bulbs or buying cleaning supplies. If you own your home, this category is a must.

- Giving. Whether it’s donating to a cause you care about or giving gifts to friends and family, these expenses add up. Having a budget category for them makes giving easier.

- Self-care. Haircuts, skincare, therapy, or even an occasional treat-yourself moment should be part of your budget. When you plan for these, you won’t feel guilty spending the money.

- Car maintenance. Oil changes, new tires, or even unexpected repairs can be pricey. Having a set budget category for these helps avoid a financial headache later.

Little expenses add up fast. Adding these budget categories helps keep your money in check while making sure nothing important gets overlooked. Planning for everything—big and small—keeps your budget running smoothly!

How to Stick to Your Budget Categories Without Feeling Restricted

Making a budget is one thing—actually sticking to it is another. It’s easy to set up budget categories, but when real life happens, following them can feel like a challenge. The trick is to build flexibility into your budget so you don’t feel like you’re constantly saying no to yourself.

Here’s how to stay on track without feeling like your budget is a burden:

- Give yourself some wiggle room. If your budget is too tight, it’ll feel impossible to follow. Set realistic limits in your budget categories so you don’t feel like you’re cutting every fun thing out of your life.

- Use cash for trouble spots. If there’s a category where you tend to overspend (hello, takeout and Target runs), try using cash for it. Once the cash is gone, you’re done spending for the month.

- Meal plan to keep grocery spending in check. One of the biggest budget-busters is food. Planning meals ahead of time can help you avoid impulse buys and unnecessary trips to the store.

- Check in weekly. Instead of waiting until the end of the month to see where you stand, do a quick budget check every week. This helps catch overspending before it gets out of control.

- Use a separate account for savings. If you leave savings in your main checking account, it’s easy to “accidentally” spend it. Moving it to a separate account makes it less tempting to dip into.

Sticking to your budget categories doesn’t mean you can’t enjoy life. It just means you’re spending with a plan instead of wondering where all your money went. A little structure now means more freedom later!

Final Thoughts

Budgeting isn’t about restricting yourself—it’s about giving your money a purpose. When you set up budget categories that fit your life, you take control of your finances instead of wondering where your paycheck disappeared to.

Throughout this post, we covered:

- How to create budget categories that work for your lifestyle. No two budgets look the same, so it’s important to personalize yours.

- Common mistakes to avoid. Forgetting irregular expenses, being too strict, or not tracking spending can throw off your whole budget.

- The hidden expenses you should plan for. Car maintenance, holiday shopping, and annual fees are just a few things that can mess up a budget if you don’t plan ahead.

- How to adjust when life changes. Your budget isn’t set in stone. It should change as your life and expenses do.

Now that you’ve got a solid plan, the next step is tracking your spending. Whether you use a budgeting app, a simple notebook, or a spreadsheet, the key is to keep up with it. Checking in weekly can help you catch problems before they get out of control.

Budget categories make managing money easier, but they’re not one-size-fits-all. Tweak them as needed and find a system that works for you. If something isn’t working, change it!

If you found these tips helpful, save this post to Pinterest so you can come back to it later. Budgeting takes practice, but once you have a plan, it becomes second nature. Stick with it, and before you know it, you’ll be making financial decisions with confidence!