Living frugally doesn’t mean giving up the things you love. It just means being smarter with your money, so you have more for what truly matters. Whether you’re looking to cut everyday costs or find creative ways to save, a few simple budget hacks can make a big difference.

If you’re anything like me, you appreciate a good deal. Finding ways to stretch every dollar feels like a win. Saving money isn’t just about cutting back—it’s about making intentional choices. The right changes can lower stress and give you more financial freedom.

Here’s what you’ll find in this post:

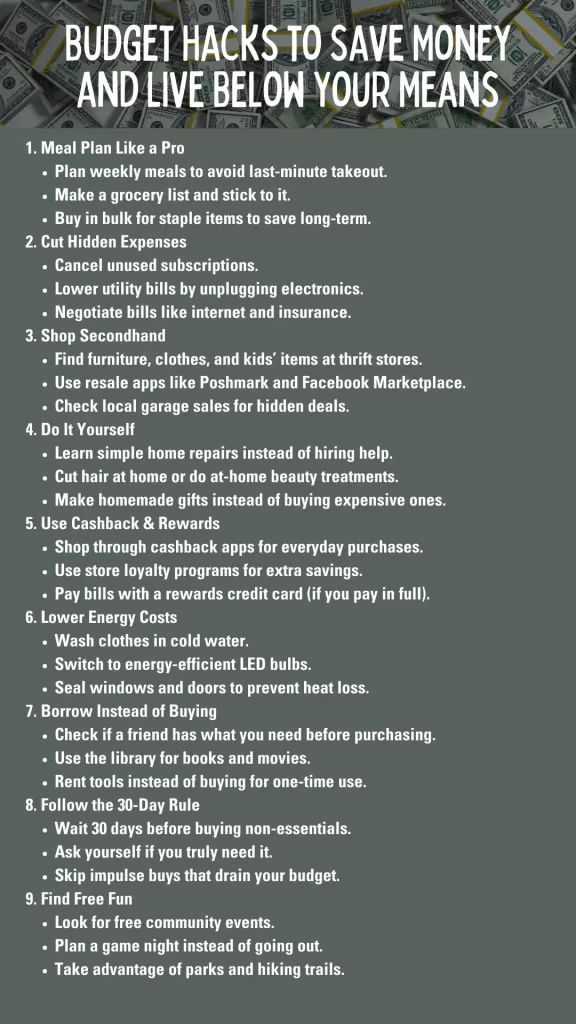

- Smart grocery savings – Meal planning, bulk buying, and how to avoid overspending at the store.

- Cutting hidden expenses – Why small subscriptions can add up fast and how to trim them.

- Shopping secondhand – How thrift stores, resale apps, and local deals can help you save.

- DIY money-savers – From home repairs to beauty treatments, doing things yourself can be a huge win.

- Cashback apps and rewards – How to make money on purchases you already make.

- Energy-saving habits – Simple ways to lower your bills without making big sacrifices.

Pinterest is full of ideas for saving money, but not all of them are practical. This list is packed with real, doable strategies that work for everyday life. Whether you’re just starting out or looking for new ways to save, these tips will help you live below your means and build better money habits. Let’s get started!

This site includes affiliate links; you can check the disclosure for more details.

Meal Planning Budget Hacks for Smarter Spending

One of the easiest ways to cut down on spending is by planning meals in advance. By knowing what you’ll cook each week, you avoid those last-minute trips to the store. You also reduce the chance of buying items you don’t need.

Here’s what meal planning looks like:

- Create a weekly menu and stick to it.

- Make a grocery list based on what’s on sale.

- Try batch cooking, so you have ready-to-eat meals for busy days.

- Freeze leftovers for future meals.

You’ll find that not only are you saving money, but you’re also cutting down on food waste. And when there’s less stress over meals, you might even enjoy cooking more.

Avoid Subscription Traps: Budget Hacks

We all have those subscriptions that seem small but add up over time. Streaming services, magazines, and fitness apps can slowly drain your budget without you even realizing it. One of the best budget hacks is to review your subscriptions every few months.

Ask yourself:

- Do I use this regularly?

- Can I find a free or cheaper alternative?

- Is there a bundle option to save money?

Cancel anything that’s not pulling its weight. You’ll be surprised how much you can save each month by trimming these little expenses.

Use Cashback Apps

Cashback apps are like free money for doing what you already do—shopping. Many apps offer cashback on groceries, online purchases, and even gas. All you need to do is upload your receipts or shop through the app’s portal.

Here are a few popular cashback apps to consider:

- Rakuten

- Ibotta

- Fetch Rewards

- Upside (great for gas savings)

With just a little extra effort, these apps can put some of your spending back into your pocket. It’s one of those budget hacks that feels effortless once you get into the habit of using them.

Embrace DIY Projects

Doing things yourself instead of paying someone else is one of the best ways to save money. Whether it’s home repairs, gifts, or even beauty treatments, a little effort goes a long way.

- Home repairs: Learn simple fixes like patching a hole, replacing a faucet, or even painting. YouTube is full of tutorials for every project.

- Homemade gifts: Crafting gifts can save you money and make your presents more personal.

- Beauty treatments: Skip the expensive salons and try at-home facials, haircuts, or manicures.

The best part? DIY projects often turn out better than expected, and you’ll feel proud of your skills.

Secondhand Shopping for Big Savings

Buying things secondhand isn’t just for thrift stores anymore. You can find excellent deals on everything from furniture to clothes by shopping secondhand. It’s one of the easiest budget hacks to adopt, and it’s better for the environment, too.

- Facebook Marketplace: Great for local furniture, baby items, and even tools.

- Poshmark: Perfect for finding trendy clothes at a fraction of the cost.

- Thrift stores: Ideal for clothing, housewares, and books.

- Garage sales: Fun and often full of hidden treasures at unbeatable prices.

By buying gently used items, you’ll save money and still get what you need. Plus, there’s a certain thrill in finding a good deal.

The 30-Day Rule for Big Purchases

Impulse buys are a budget killer. We’ve all been there—something catches your eye, and before you know it, you’ve spent money you didn’t plan to. A simple way to avoid this is by using the 30-day rule.

Here’s how it works:

- When you find something you want to buy, wait 30 days.

- After the 30 days, if you still want it and can afford it, go ahead and buy it.

- Often, you’ll find that the desire for the item fades, saving you from unnecessary purchases.

This is one of the budget hacks that forces you to think twice before spending. It helps keep your priorities straight and your bank account happier.

Automate Your Savings

Saving money doesn’t have to be hard. In fact, one of the easiest ways to save is by automating it. Setting up automatic transfers to your savings account ensures that money is set aside before you can spend it.

Here’s how to make it work:

- Set a specific amount to transfer each payday.

- Treat it like a bill that has to be paid.

- Start small if you need to, but increase it as your budget allows.

You’ll be amazed at how quickly your savings grow when you don’t have to think about it. This is one of those budget hacks that feels painless but pays off big over time.

Budget Hacks: Plan Free Activities

Entertaining yourself or your family doesn’t have to break the bank. There are tons of free or low-cost activities that you can enjoy without spending a dime. Whether it’s exploring nature or doing something creative at home, you can keep things fun on a budget.

Some ideas include:

- Hiking at a local park

- Hosting a movie night with popcorn and blankets

- Visiting a museum on a free day

- Attending community events like outdoor concerts or festivals

By seeking out free activities, you can keep yourself entertained while sticking to your budget.

Use a Budgeting App

Tracking your spending might seem like a chore, but it’s a necessary part of frugal living. A budgeting app can simplify the process and help you see where your money is going. It’s one of the most effective budget hacks because it makes you accountable.

Popular budgeting apps include:

- YNAB (You Need A Budget)

- Mint

- EveryDollar

- Goodbudget

These apps break down your spending and help you create a plan. Once you see where your money is going, you can make better choices about where to cut back.

Shop Around for Insurance

Insurance is one of those things we pay for but don’t often think about. However, shopping around for better rates every year or two can save you hundreds. Whether it’s car insurance, home insurance, or health insurance, you could be paying more than you need to.

To find better rates:

- Contact multiple companies and compare quotes.

- Ask about discounts for bundling policies or being a long-term customer.

- Reevaluate your coverage needs to ensure you aren’t paying for things you don’t need.

This is one of the best budget hacks for saving on an expense that’s often overlooked.

Energy-Saving Budget Hacks at Home

Saving money on your energy bill doesn’t require major investments in solar panels or a complete remodel. Small changes can add up to big savings over time. Plus, reducing energy consumption is great for the environment.

Here are a few habits to adopt:

- Turn off lights and appliances when not in use.

- Use energy-efficient bulbs and appliances.

- Wash clothes in cold water and air dry when possible.

- Seal windows and doors to prevent drafts.

These simple habits can reduce your energy bills and help you live more sustainably.

Use Coupons Wisely

Coupons aren’t just for extreme couponers. With a little planning, they can help you save on groceries, household items, and even personal care products. Many stores have apps where you can load digital coupons, making it easier to use them without cutting paper.

Here are some tips:

- Only use coupons for items you already plan to buy.

- Combine store sales with coupons for even more savings.

- Sign up for your favorite stores’ loyalty programs for extra discounts.

By using coupons wisely, you can shave a few dollars off your bill every time you shop, adding up to significant savings over time.

Borrow Before Buying

Instead of buying something you’ll only use once, consider borrowing from a friend or family member. Whether it’s a tool, kitchen gadget, or even a book, borrowing is an easy way to save money.

Think about borrowing for:

- Power tools for a one-time home project

- Books you’ll only read once

- Formalwear for special events

You’ll save money and avoid cluttering your home with items you rarely use.

Reevaluate Your Wants vs. Needs

It’s easy to get caught up in buying things because they look nice or because others have them. But part of living frugally is being able to separate your wants from your needs. Every time you think about buying something, ask yourself if it’s truly a need.

Here are some questions to consider:

- Will this purchase improve my life?

- Can I live without it?

- Is there a cheaper or free alternative?

By focusing on your needs, you’ll naturally reduce unnecessary spending and live below your means. It’s one of the most effective budget hacks to keep in mind every day.

Final Thoughts on Budget Hacks

Saving money doesn’t have to feel restrictive. With the right budget hacks, you can live below your means without missing out on the things that matter most. It’s not about cutting everything—it’s about making smarter choices.

Throughout this post, I covered practical ways to stretch your budget, including:

- Meal planning and grocery savings – How a little preparation can prevent impulse spending and food waste.

- Cutting hidden expenses – Why small monthly charges can add up and how to reduce them.

- Shopping secondhand – Where to find high-quality, budget-friendly items.

- DIY projects and repairs – How doing things yourself can lead to big savings.

- Cashback and rewards programs – The easiest way to get money back on things you already buy.

- Energy-saving habits – Simple steps to lower your bills every month.

Small changes make a big impact. Whether you’re tweaking your grocery budget, swapping out expensive habits, or rethinking how you shop, every little effort adds up. The key is to stay intentional. Once saving money becomes a habit, it’s easier to stick with it.

Pinterest is filled with money-saving ideas, but not all of them fit real life. The budget hacks in this post are practical, easy to follow, and designed to help you keep more of your hard-earned money. Try a few, see what works, and start making your money go further.