Some days, it feels like you’re trying everything, but that debt free life still feels miles away. You skip coffee runs, stretch your groceries, and say no to things you want. But somehow, the debt still sticks around. I get it. So, I put this post together to share what really works when you are feeling stuck!

I’ll walk you through real steps that make a real difference. Not fluff. Not vague advice. Just clear, easy ideas you can start right away.

Here’s a quick peek at what you’ll find inside:

- The simple trick that helped me finally stick to a budget

- A full action plan to knock out your debt without giving up fun

- The easiest way to track spending (even if you hate numbers)

- How to prep for expenses so you never panic when they pop up

- Fun, free ways to enjoy life without swiping your card

- Budgeting tips that actually work in a busy life

I’ll also explain how small, everyday habits can lead to big wins. And yes, there’s even a section on how to make a plan that actually sticks. You don’t have to feel stuck anymore.

Whether you’re a mom trying to make ends meet or just tired of living paycheck to paycheck, you’re in the right place. This isn’t some Pinterest-perfect plan that works only for people with six-figure incomes. This is for real life.

By the end of this post, you’ll feel ready. You’ll have steps to follow and a plan that feels doable. So if you’re ready to take control of your money and finally feel some peace, keep reading. It’s time to make debt a thing of the past.

Start with Why You Want to Be Debt Free

Before jumping into saving tricks, take a second and think about why you want to be debt free. This sounds basic, but it matters.

Knowing your reason helps you stay focused. If you don’t have a clear “why,” it’s easy to give up.

Here are some reasons people aim for a debt free life:

- To stop feeling stressed all the time

- To be able to help their kids with college

- To retire without worry

- To take that vacation they’ve been putting off

- To stop living paycheck to paycheck

Your reason might be different. Maybe it’s just wanting to breathe easier at night. That’s a strong enough reason. You don’t have to explain it to anyone. You just have to believe in it.

Once you know your reason, write it down. Put it somewhere you can see often. On your fridge. In your planner. On your phone lock screen.

Your “why” is your fuel. When you’re tempted to overspend or stop budgeting, go back to it. It’ll help you make better choices.

Another helpful thing? Talk to a friend about it. Say it out loud. That makes it feel real. It also helps if someone else knows what you’re working toward.

Don’t feel silly if your reason is something like wanting new clothes without guilt. If that matters to you, it matters.

The keyword might be “debt free,” but the heart behind it is freedom. Freedom to say yes to what matters. Freedom to say no without guilt. That’s what keeps you going.

So before you cut any spending, remind yourself why you’re doing this. That’s step one. And it’s a big one.

Easy Budgeting That Doesn’t Feel Like a Chore

Let’s talk budgeting. I know, the word sounds boring. But stick with me. It doesn’t have to be hard.

A simple budget helps you feel in control. Think of it like a GPS for your money. You decide where you want to go—and then make a plan to get there.

Here’s how to make one that actually works:

- Start with your income. What’s coming in every month?

- Then list your fixed costs. Rent, utilities, phone bill.

- Add your flexible costs. Things like groceries, gas, and eating out.

- Give yourself a line for savings. Even $20 counts.

- Don’t forget a little fun money. This keeps you from feeling deprived.

Some people love spreadsheets. Others just jot things down on paper. Do what works for you.

A few tips to keep your budget working:

- Check in with it weekly

- Tweak it as life changes

- Don’t beat yourself up for going over

- Adjust and try again

Budgets aren’t about saying no to everything. They help you say yes to the right things. They also shine a light on where your money sneaks off to.

Trying to live debt free without a budget is like baking without a recipe. You might get lucky. But chances are, it won’t come out right.

So, find a method that fits your life. Keep it simple. Keep it real. And don’t forget to reward yourself when you hit a goal.

How Affirmations Help You Stay Debt Free

Affirmations might sound cheesy, but don’t count them out just yet. When you’re working toward a debt free life, your mindset matters just as much as your money.

It’s easy to feel overwhelmed or discouraged. That’s where affirmations come in. They’re short, powerful sentences that help keep your thoughts focused and your attitude strong. When you repeat them, you start to believe them. And when you believe them, you take action.

Here’s how to use them:

- Say them out loud every morning

- Write them on sticky notes and put them on your mirror

- Add one to your phone lock screen

- Use them when you feel tempted to overspend

- Read one before you pay your bills

Some simple affirmations to try:

- I am in control of my money

- I release all fear about finances

- I am becoming debt free one step at a time

- Every dollar I spend has a purpose

- I am proud of the progress I’m making

- I have more than enough to meet my needs

- I am building a future with freedom and peace

Affirmations won’t magically pay off your bills. But they do keep your head in the right space. When your thoughts are steady, your actions follow.

Pair them with a vision board, a plan, and daily habits. That’s when things start shifting. That’s when goals turn into real change.

So pick a few affirmations and start using them today. Keep them visible. Keep them honest. Keep them simple. They’re small but mighty. And when your heart believes in the journey, the rest of you will keep going.

Little Everyday Habits That Make a Big Impact Towards Becoming Debt Free

Small changes matter. You don’t have to flip your life upside down overnight. Just start where you are.

Here are tiny habits that lead to big results:

- Cook at home more often

- Bring your own drinks instead of buying them

- Use cash for things like groceries

- Pause before buying anything online

- Unsubscribe from store emails that tempt you

Even picking up change off the ground counts. Seriously. The little stuff adds up fast.

Some other helpful habits:

- Check your bank app once a day

- Use a grocery list every time you shop

- Pick one “no spend” day each week

- Cancel one subscription you forgot about

- Look at your goals every morning

It’s not about being perfect. It’s about being aware. When you start to notice your money, it starts to stick around longer.

Being debt free is more about mindset than money. These small shifts help you build that mindset. They help you become the kind of person who’s in charge of their money.

The point is progress, not perfection. So if you mess up one day, just start again the next. One good choice can undo a dozen bad ones. You’re not behind. You’re learning. And that’s a win.

Finding Free Fun So You Don’t Feel Left Out

Paying off debt doesn’t mean you can’t have fun. You just have to get a little creative. Good news? There are tons of ways to enjoy life without spending a dime.

Here are some ideas to try:

- Host a board game night with friends

- Have a picnic at a local park

- Go on a photo walk and take fun pictures

- Visit the library for books and free events

- Look up free museum days in your area

You can also:

- Watch movies at home with popcorn

- Swap clothes with a friend for a closet refresh

- Try new recipes with what you already have

- Do a puzzle or craft using leftover supplies

Feeling bored? Check local Facebook groups. There’s often something going on nearby for free.

When you stop spending money just to stay busy, you find things that bring real joy. You might even find you like the slower pace.

Debt free living doesn’t mean lonely living. In fact, it often leads to deeper connections. Instead of buying your way into fun, you build it with people who matter.

So don’t let the fear of missing out take over. There’s still fun to be had. You just have to look in different places.

Keep a list of free ideas on your phone. That way, you always have something to do that won’t hurt your wallet.

Tips to Make Credit Card Debt Payoff Actually Happen

Credit card debt feels heavy. It builds fast and takes forever to shake off. But paying it off is possible. And you don’t have to be perfect to do it.

The first step? Stop adding to it. Put the cards away. Use cash, a debit card, or nothing at all until you have a plan.

Then write down everything you owe:

- Card name

- Total balance

- Interest rate

- Minimum payment

Seeing it all at once can be a little scary. But it also gives you power. You can’t fix what you won’t face.

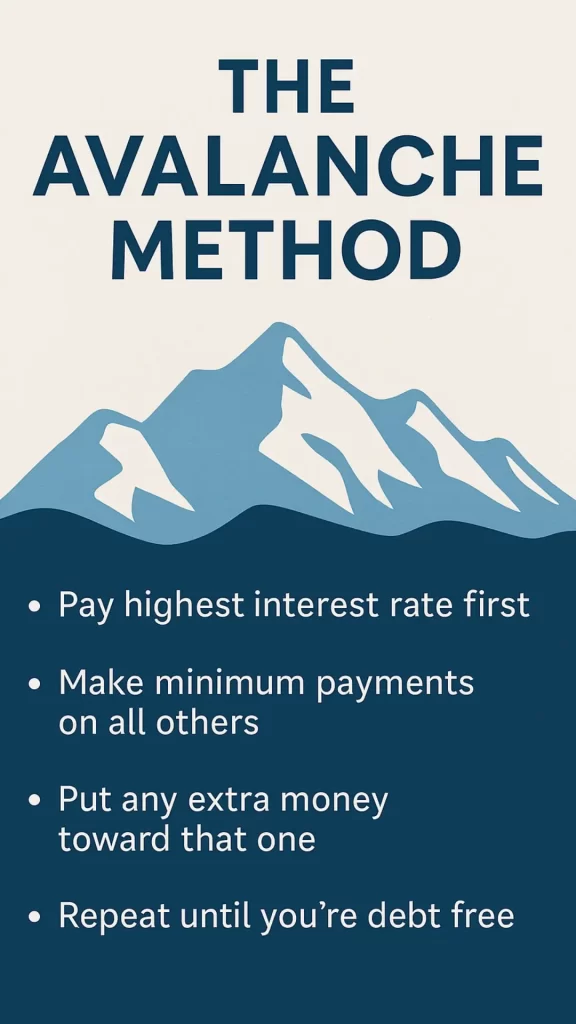

Next, choose a payoff method:

- Snowball: Pay the smallest card first to build momentum

- Avalanche: Pay the card with the highest interest first to save money

Pick the one that keeps you going. There’s no wrong choice here.

Want to make credit card debt payoff faster?

- Call your card company and ask for a lower rate

- Transfer a balance to a card with a 0% intro rate

- Use cash-back apps and send the bonus straight to your payment

- Sell something and use the money to pay down a card

Even $20 extra helps. Every little bit gets you closer.

Don’t skip your payments. Pay on time. That keeps your credit score from dropping while you work on getting free.

Paying off cards takes time, but it’s so worth it. You’ll sleep better. You’ll stop worrying about interest. And you’ll feel proud every time your balance drops.

Keep showing up. Keep paying what you can. And watch that debt shrink, one smart move at a time.

Simple Ways to Save Without Feeling Like You’re Struggling

Saving doesn’t have to hurt. You don’t need to skip every joy in life to build a cushion. In fact, the best savers often look like average folks just doing small things well.

Here’s how to start:

- Round up your purchases and move the change to savings

- Use a separate account just for saving

- Try a savings challenge like the $5 bill rule

- Save your tax refund instead of spending it

Want more ideas?

- Use store apps for deals and rewards

- Buy secondhand whenever possible

- Skip delivery fees by picking up orders

- Plan meals based on what’s on sale

- Use coupons, but only for things you actually need

Saving doesn’t have to be boring either. Make it feel good. Every time you hit a mini goal, celebrate.

Saving while aiming to be debt free gives you breathing room. It means fewer surprises knock you down. It means when the car breaks, you don’t break with it.

You’re not saving just for the sake of it. You’re saving so you can feel strong. Secure. Ready.

Even if it’s just $10 here and there, keep going. Tiny steps lead to big wins. Saving is just like brushing your teeth—do it daily, and it becomes second nature.

Stick with it. You’ll thank yourself later.

Create a Step-by-Step Plan to Pay Off What You Owe

Let’s make an actual plan. Not just hope. A real plan that shows you how to pay off debt. Becoming debt free doesn’t happen by wishing. You need a list, a method, and a little grit.

Start by writing down all your debts:

- Credit cards

- Car loans

- Medical bills

- Student loans

- Any personal loans

Include the total amount, interest rate, and minimum monthly payment. Then pick a payoff method:

Option 1: Snowball Method

- Pay smallest debt first

- Make minimum payments on all others

- Put any extra money toward the smallest one

- Once that’s paid off, move to the next smallest

Option 2: Avalanche Method

- Pay highest interest rate first

- Still make minimum payments on others

- Throw extra money at that highest rate one

- Repeat until you’re done

Pick whichever one keeps you going. Some people love the quick wins with snowball. Others like saving more money long-term with avalanche.

Now look at your budget. Find where extra money can go toward debt:

- Can you skip fast food?

- Cancel one streaming service?

- Sell stuff around the house?

- Pick up a small side job?

Every extra $10 helps. Seriously. It adds up fast when you’re focused.

The keyword might be debt free, but the real goal is peace. That starts with having a plan. When you see progress, you stay motivated. You start believing you can really do this.

So take an hour this week. Make that list. Pick your method. And start knocking those debts out one by one.

How to Pay Off $25,000 in One Year

Paying off $25,000 in a year sounds huge. But don’t scroll past this yet—it’s possible with the right plan.

The first thing to do is break it down.

$25,000 ÷ 12 months = about $2,084 per month.

That feels like a lot, right? Let’s take it step by step.

Here’s how to make it happen:

Step 1: Cut what you don’t need

- Pause subscriptions and memberships

- Limit eating out

- Stick to needs, not wants

- Skip big vacations for now

Step 2: Add more income

- Pick up a weekend job

- Offer babysitting or pet sitting

- Sell stuff you don’t use

- Try grocery delivery or food delivery apps

- Offer simple services like house cleaning

Even a few hundred dollars a month helps. Everything counts.

Step 3: Track your money

- Use a free app or notebook

- Write down every expense

- Look for places to trim

- Know where every dollar is going

Step 4: Use the Snowball or Avalanche method

- Make a list of all debts

- Pick your payment strategy

- Stick to it every single month

- Celebrate each win

Step 5: Stay focused

- Print a tracker and color it in

- Share your goal with a friend

- Take breaks when you feel overwhelmed

Becoming debt free in a year means being bold. You’ll have to say no to some things. But you’ll say yes to freedom. You’ll be in control. No more juggling bills. No more stress about what’s coming next. Just clear, steady progress. And that’s worth every bit of effort.

Track Every Dollar Without Going Nuts

Tracking your spending sounds boring, right? I used to think that too. But here’s the thing—if you want to be debt free, you have to know where your money goes. Like, really know.

Don’t worry, you don’t need to be perfect. You just need to start paying attention.

There are two easy ways to track:

- Use a notebook or planner

- Download a free budgeting app (like Mint or EveryDollar)

Pick whichever one you’ll actually use. That’s the key.

Here’s what to track:

- Every bill you pay

- Every trip to the store

- All your fast food runs

- Random gas station snacks

- Online orders (even the small ones)

Just write it down or plug it in. That’s it. At the end of the week, look at your list. You might be shocked. I was.

Chances are, you’ll find a few places where money slips away. Maybe it’s daily coffee. Or too many impulse buys. Once you see it, you can fix it.

Some tips to make tracking easier:

- Keep receipts in a zip pouch

- Take five minutes at night to jot things down

- Color code your spending categories

- Set reminders on your phone

Tracking helps you feel more in control. It’s not about shame or guilt. It’s about awareness.

You can’t move toward a debt free life if you don’t know what’s eating your cash. Tracking makes it clear. When it’s clear, you can change it.

This one habit makes a huge difference. Try it for one week. Just one. You’ll learn more than you think.

Start a Sinking Fund (Yes, Even on a Tight Budget)

Let’s talk about sinking funds. Sounds odd, right? But it’s one of the smartest things you can do to stay debt free.

A sinking fund is just money you save for stuff you know is coming. Like birthdays, holidays, or new tires. The point is to save a little at a time instead of panicking when the bill hits.

Here’s how to start:

- Make a list of known future expenses (big and small)

- Pick one or two to focus on first

- Figure out how many weeks or months you have before you’ll need the money

- Divide the cost by that number to see what to save each week

For example:

- Christmas in 6 months

- Budget: $300

- Save $50 a month or around $12.50 a week

Stick that money in an envelope, jar, or a separate savings account. Don’t touch it unless it’s for that thing.

Ideas for what to build sinking funds for:

- School clothes or supplies

- Annual car registration

- Family vacations

- Emergency vet visits

- Birthday parties

Even if money’s tight, start small:

- $5 a week is fine

- Use rebate apps or coin jars

- Save grocery cashback rewards

This little trick saves you from using credit cards for big stuff. It’s like planning ahead so your future self doesn’t freak out.

Being debt free isn’t just about paying off old debt. It’s about not creating new debt. That’s where sinking funds really shine.

It’s one of those things you’ll wish you started sooner. Simple, easy, and it works. So, grab an envelope and get started today.

Final Thoughts on How to Be Debt Free and Stay That Way

Being debt free isn’t just about numbers. It’s about peace. It’s about having room to breathe and think clearly.

Throughout this post, I’ve shared ways to help you shift your habits and stay on track. We talked about starting with your why. That reason you’re doing all this hard work matters more than anything.

We broke down easy ways to budget. Nothing fancy—just a simple way to tell your money what to do. I gave you little everyday habits to help you feel more in control. And we talked about finding free fun so you can enjoy life while you save.

I also covered real-life ways to save money without feeling like you’re always missing out. All these ideas are meant to work together. You don’t have to do them all at once. Just pick one to start with. Then another. That’s how real change happens.

The goal isn’t to be perfect. It’s to keep going. To build a life where you can sleep well and not worry about the next bill. That’s what living debt free is really about.

And one last thing. If you’re someone who scrolls Pinterest looking for simple tips and tricks, save this post. Come back to it when you need a boost. Use it like a checklist or a pep talk. You’ve got this. You really do.

Because every step you take puts you closer to the life you want. And you deserve that life. One day at a time.