Money stress wears me out. I see it when I’m shopping, paying bills, and even scrolling Pinterest. I spot things and suddenly feel like I need them. But sticking to minimalist money habits has helped me quiet all that noise. It’s not about pinching every penny or saying no to fun. It’s about making money simple and clear.

In this post, I’m going to show you how to:

- Cut down on spending without feeling deprived.

- Set up simple systems that take care of themselves.

- Shop smarter, especially for groceries.

- Plan for fun spending, guilt-free.

- Teach these same habits to kids and teens.

I’ll also talk about sneaky costs that drain your budget when you’re not looking. You know the ones—random subscriptions and impulse buys. I’ll help you stop them before they mess things up.

If you’ve ever felt like your money disappears too fast, this post is for you. I’ll show you little things that make a big difference. We’ll keep it simple and doable. You won’t need fancy apps or long spreadsheets. Just real ideas that work in everyday life.

I’ll walk you through setting up easy plans for bills, savings, and spending. Plus, I’ll share how I make grocery shopping less expensive and less stressful. I even have ideas for holidays and birthdays so you can save without missing out.

Minimalist money habits are simple changes. They help you feel calm and in control. By the end of this post, you’ll have easy ways to make your money work for you. No more stress, just smart habits you can stick to.

This site includes affiliate links; you can check the disclosure for more details.

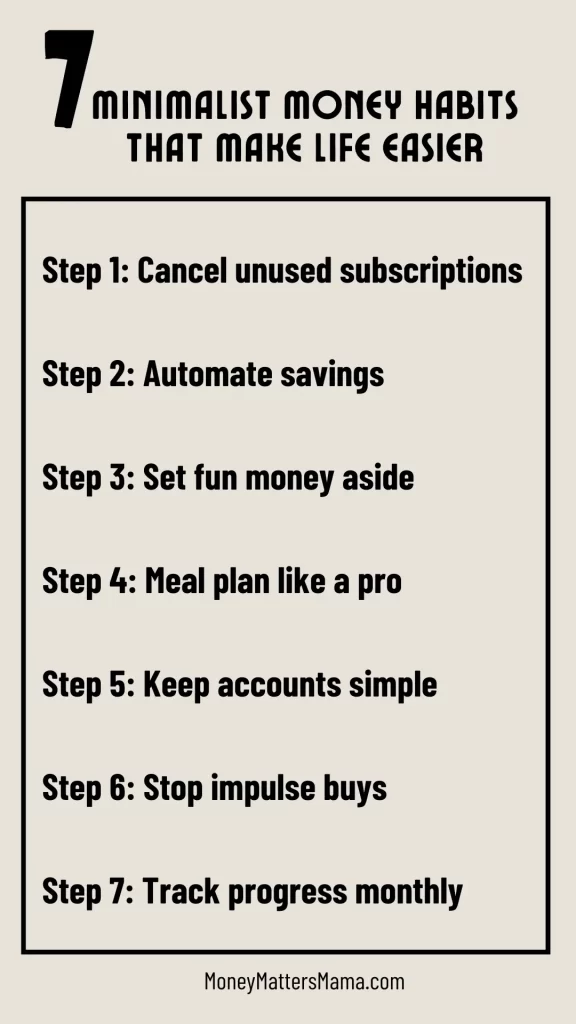

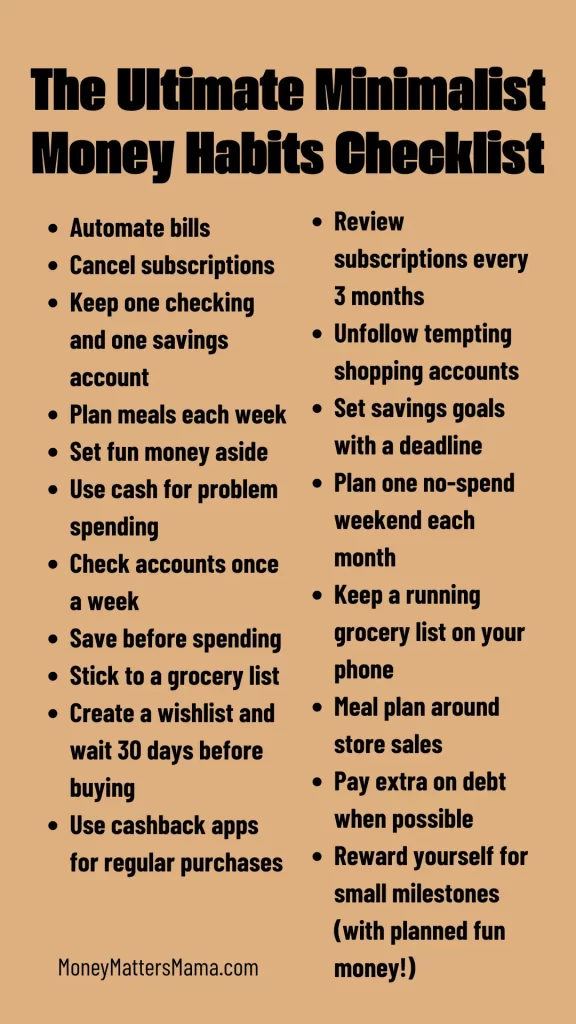

Automate and Forget It

The easiest way to save? Take decisions out of it. When money moves automatically, you don’t have to rely on willpower.

- Set up automatic savings. Even if it’s just $10 a week, it adds up fast.

- Use autopay for bills. No more late fees or missed payments.

- Round-up apps help, too. Apps that round up purchases and save the spare change make it effortless.

You don’t need a complicated budget if money is automatically going where it needs to. The less you have to think about it, the better.

Declutter Subscriptions and Recurring Costs

Subscriptions are sneaky. A few dollars here, a few dollars there—it adds up before you even realize it.

- Go through your bank statements and cancel anything you don’t use.

- Ask yourself: Would I re-subscribe today if this was a new purchase?

- Don’t forget annual subscriptions! Those charges hit hard when you’re not expecting them.

Cutting just one or two subscriptions can free up extra cash for things you actually want.

Buy Less, Buy Better

Shopping is fun. But it’s also the fastest way to drain your bank account. Instead of buying more, shift to buying better.

- Quality over quantity. A well-made pair of shoes lasts years. Cheap ones fall apart fast.

- Think before you buy. Wait 24 hours. Still want it? Then it’s probably worth it.

- Own less, love more. Too much clutter? It’s usually from impulse buys that don’t actually bring joy.

Minimalist money habits aren’t about never spending. They’re about spending intentionally.

Meal Plan Like a Pro

Meal planning used to feel like a chore. But once I made it part of my minimalist money habits, everything changed. Grocery shopping got easier. I wasted less food. I saved more money. Plus, I stopped making last-minute trips to the store.

Here’s how I make meal planning simple and doable each week:

- I check my calendar first. If we have busy nights, I plan easy meals.

- I look through the fridge, freezer, and pantry to see what needs to be used up.

- I write down five dinners, two lunch ideas, and simple breakfast options.

I don’t plan every single meal. I leave room for leftovers or simple “whatever” nights. That keeps things flexible.

When making my grocery list, I stay focused:

- Start with the ingredients for those planned meals.

- Add snacks and basics, like milk and bread.

- Double-check for items like spices, oils, and baking needs.

- Write down quantities to avoid buying too much.

At the store, I stick to the list. No extras. If I see something tempting, I remind myself that impulse buys add up fast. They break budgets and lead to wasted food.

Some meal planning tips that have saved me money:

- Plan one night for leftovers or “clean out the fridge” meals.

- Make one meal stretch into two. Roast chicken one night becomes chicken tacos the next.

- Buy larger packs of meat when on sale and freeze portions.

- Use frozen veggies. They last longer and cut down on waste.

Meal planning doesn’t have to be fancy. Just smart. Minimalist money habits in the kitchen make my life easier. And my wallet happier.

Keep Finances Simple

I used to think having lots of accounts meant I was organized. But it just made things confusing. One of the best minimalist money habits I follow is keeping my finances simple. When things are simple, I don’t feel stressed. I know where my money is and what it’s doing.

Start by trimming down accounts. Here’s what I recommend:

- One checking account for spending and bills.

- One savings account for emergencies and big goals.

- A separate cash envelope or prepaid card for fun money.

That’s it. More accounts just mean more logins and more mental clutter.

I also set clear rules for myself. Simple rules that are easy to follow:

- If I can’t pay for it now, I don’t buy it.

- Every payday, I move a set amount to savings.

- I only check accounts once a week to avoid obsessing.

Problem spending areas need special attention. For me, that used to be online shopping. My fix? I started using cash for fun money. If I didn’t have the cash, I didn’t spend it. It really worked.

Another helpful tip: pick a savings number. This is the amount that makes me feel safe. For some, it might be $1,000. For others, $500 is enough. When I hit that number, I can relax a bit. If it dips below, I focus on building it back up.

Minimalist money habits are about ease. I don’t use apps I don’t understand. Don’t make complicated budgets. I keep it simple so I can stick with it. And honestly, simple feels so good. It clears my mind and makes money feel less scary.

Set Fun Money Aside—Without Guilt

I used to feel bad spending money on little treats. But I’ve learned fun money is part of smart minimalist money habits. Saving is great, but life needs joy, too. The trick is planning for it, not feeling guilty afterward.

First, figure out how much fun money you can afford. I like to think of it as a set percentage. For me, 5 to 10 percent of my monthly income feels right. Some months, it’s more. Some months, less. But it’s always planned.

Once I decide the amount, I make it separate. I either:

- Put cash in an envelope marked “Fun.”

- Use a prepaid card for small splurges.

- Set up a second bank account just for this.

The cash method works great if you like seeing money leave your hand. It keeps you honest. The separate account works better for online shopping or treating myself to coffee runs.

I also keep a small list of fun ideas. That way, when I feel the urge to spend, I have ready options. My list includes:

- Trying a new coffee shop.

- Buying a book I’ve wanted for months.

- Getting ice cream with my kids.

- Picking up flowers for my kitchen table.

- Downloading a new movie for a night in.

The key with minimalist money habits is spending mindfully. No guilt. If the money is set aside for fun, I enjoy it. I don’t feel bad about spending it, and I don’t dip into savings.

Fun money keeps me from overspending. It feels like a reward. Plus, it makes saving easier. I know I still get to enjoy little moments along the way.

Say No to Debt (and Pay Off What You Can)

Debt is exhausting. It keeps you stuck in the past instead of planning for the future.

- Stop adding new debt first. No extra charges unless absolutely necessary.

- Pick one debt to focus on and attack it.

- Celebrate small wins. Every little bit counts.

Even small payments help. Progress is progress.

Minimalist Money Habits for Kids and Teens

Teaching kids about money doesn’t have to be hard. I’ve learned that starting simple works best. The earlier they learn minimalist money habits, the better they’ll handle money later. You don’t need fancy charts or apps. Just real conversations and easy steps.

Here’s what I suggest for teaching kids:

- Give them a set allowance. Don’t make it too big. It should teach value.

- Break money into three parts: save, spend, and give.

- Let them make mistakes with small amounts. They’ll learn from it.

- Talk about wants versus needs. Show real examples at the store.

- Let them save for something special. Waiting teaches patience and value.

For teens, things shift a little. They’re more independent. But they still need guidance.

- Help them open a savings account. Show them how it works.

- Encourage part-time work. Babysitting, mowing lawns, or dog walking are great starts.

- Talk about credit early. Explain debt in easy words.

- Teach them to save for big things, like a car or college costs.

Minimalist money habits for kids and teens help them grow up smart with money. No one wants their kid to learn money lessons the hard way. Small, simple lessons add up over time.

I love seeing kids learn to be proud of their savings. It builds confidence. And teens who understand money early feel ready to handle life. No confusion, no stress.

I also keep it fun. We do challenges. Who can save the most in a month? They get excited! That’s the goal. Make money simple and rewarding. Before you know it, they’re handling money like pros.

Minimalist Money Habits in the Grocery Store

Grocery shopping can destroy a budget if you’re not careful. I’ve learned that sticking to minimalist money habits makes every trip easier and cheaper.

Before heading to the store, I make a meal plan. Nothing fancy. Just five dinners, one lunch option, and breakfast stuff. Simple plans save time and money.

Here’s how I shop smart:

- Shop my pantry first. I use what I already have.

- Write a list based on the meal plan. No extras!

- Stick to the outer aisles. That’s where fresh food lives.

- Avoid pre-cut or pre-packaged foods. They cost more.

- Compare prices. Sometimes store brands are just as good.

- Shop once a week. Fewer trips mean fewer temptations.

I also set a budget before going. If I plan to spend $150, I aim for $140. That gives me wiggle room.

Minimalist money habits in the grocery store are all about focus. I remind myself: I’m here for food, not fun. If I want treats, I plan them into the budget. No impulse buys.

Coupons are great, but only if they’re for something I’d buy anyway. Otherwise, they trick me into spending more. I avoid buying in bulk unless I know we’ll use it all. Wasted food is wasted money.

I also shop after eating. A full stomach saves my wallet. Grocery trips feel less stressful now. I know exactly what I need and leave with just that.

Minimalist Money Habits for Holidays and Birthdays

Holidays and birthdays can really spiral quickly, huh? But sticking to minimalist money habits makes them special without blowing the budget.

For birthdays, I keep things simple but thoughtful. Here’s how:

- Set a spending limit. I stick to it no matter what.

- Choose one big gift or a few small ones. Not both.

- Make homemade cards. They feel more personal.

- Bake the cake myself. It’s fun and saves money.

- Skip party favors. No one misses them.

For holidays, it’s all about planning early. Last-minute shopping costs more.

- Make a gift list in October. Yes, October!

- Watch for sales and grab deals as I go.

- Use cashback apps for extra savings.

- Stick to simple decorations. I reuse what I have.

- Do secret Santa for large family gatherings.

I also talk to family about keeping things simple. No one wants to spend more than they need to. We focus on time together, not just gifts.

Minimalist money habits for holidays and birthdays keep stress away. I never feel like I’m drowning in bills afterward. I focus on what matters. Thoughtful gifts and shared moments mean more than mountains of presents.

I also remind myself: memories last longer than things. The best part? Everyone’s happier when things stay simple and fun.

Final Thoughts on Minimalist Money Habits

Minimalist money habits make life easier. They help you spend less time worrying about finances and more time enjoying life. The best part? You don’t have to follow every single tip. Even choosing one or two can make a huge difference.

The goal isn’t perfection. It’s progress. The more you simplify, the more freedom you have. Whether it’s cutting extra expenses, streamlining bills, or meal planning smarter, every little step counts.

If this post was helpful, save it to Pinterest so you can come back to it later. Because when money feels simple, life feels lighter.