Creating a money vision board is more than just a fun craft project. It’s a powerful way to stay focused on your financial goals. When you see your money goals every day, they feel more real. That daily reminder can help you make smarter choices, whether you’re saving, paying off debt, or planning for the future.

In this post, I’ll walk you through everything you need to know to build a money vision board that actually works. You don’t need anything fancy—just a few supplies, some creativity, and a clear plan.

Here’s what you’ll find:

- How to set financial goals that make sense for you – Whether it’s saving for a dream vacation or paying off a credit card, your board should reflect what matters most.

- What to put on your money vision board – Pictures, words, and even a few unique touches to make it feel personal and inspiring.

- Ways to keep your board working for you – A vision board isn’t helpful if it just sits in a corner collecting dust. I’ll share tips on how to use it daily.

- Creative ideas to make it interactive – Think savings trackers, goal deadlines, and even a digital version (hello, Pinterest lovers!).

By the end, you’ll have a money vision board that helps you stay motivated and on track. Whether you want to grow your savings, crush debt, or just feel more in control of your money, this is a great place to start. Grab your scissors and let’s get started!

This site includes affiliate links; you can check the disclosure for more details.

Why a Money Vision Board?

If you’ve ever found yourself scrolling online, dreaming of things you’d buy if you had more money, you’re not alone. We all have goals—whether it’s saving for a house, paying off debt, or taking that vacation we’ve been dreaming about. But without a plan, those goals stay just that—dreams.

A money vision board helps bring focus. It’s a visual reminder of what you’re working toward and how you’re going to get there. You can use it to set clear financial goals and keep track of your progress.

Here are a few reasons a money vision board can be helpful:

- Clarity: It’s easier to stay motivated when you can see what you’re working toward.

- Accountability: When you see your board every day, it’s a reminder to stay on track.

- Actionable steps: It’s not just about dreaming; it’s about creating a plan and sticking to it.

What You Need for Your Money Vision Board

Don’t worry, you don’t need anything fancy to get started. Most of the items you likely already have at home. Here’s a list to help you out:

- Poster board or corkboard

- Magazines or online printouts

- Scissors

- Glue or thumbtacks

- Markers or pens

- Stickers, if you want to add some flair

Now that you’ve gathered your supplies, it’s time to start thinking about what will go on the board.

Setting Financial Goals

Before you start cutting out pictures or writing things down, it’s important to get clear on your financial goals. What are you aiming for? Are you trying to pay off credit card debt? Save for a down payment on a house? Build an emergency fund? You need to be specific.

Here’s a breakdown of possible financial goals:

- Short-term goals: This could be paying off small debts, building an emergency fund, or saving for a new appliance. These are things you plan to accomplish within a year.

- Medium-term goals: Saving for a car, building a more robust emergency fund, or paying down larger debts.

- Long-term goals: Buying a home, saving for retirement, or paying off a mortgage.

Once you’ve got your goals set, break them down into smaller, actionable steps. For example, if your goal is to save $5,000 in a year, you’ll want to figure out how much you need to set aside each month.

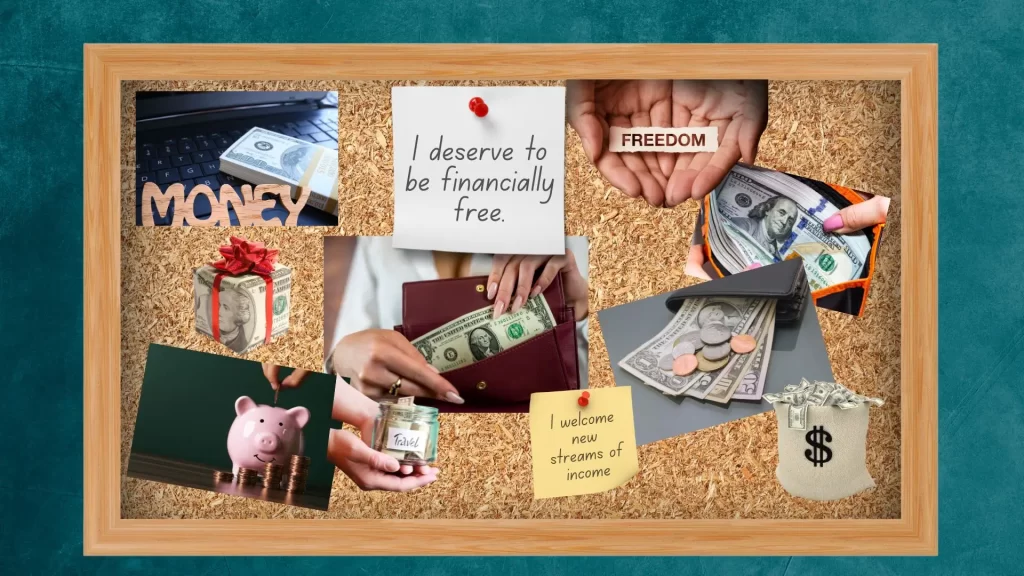

Finding Visuals for Your Money Vision Board

This part is fun! You want your vision board to be inspiring, so find visuals that represent your financial goals. For example:

- Pictures of a house: If buying a home is one of your goals, find a picture of your dream home or something similar.

- Savings goals: You could use images of a piggy bank or a number that represents how much you want to save.

- Debt-free living: Find pictures that symbolize freedom, like wide-open spaces or someone cutting up a credit card (if paying off debt is a focus).

You can find these visuals in magazines, but if you don’t have any lying around, no worries. Use online resources to print out what you need. Just search for images that resonate with your goals and cut them out.

Adding Words to Your Board

Pictures are great, but sometimes words can really drive home the message. Add motivational words or phrases that will encourage you when times get tough. You can write out your specific goals, like “Save $1,000,” or you could use general motivating words like “freedom” or “security.”

- Examples of words you might include:

- “Debt-free”

- “Retirement”

- “Emergency fund”

- “New car”

- “Vacation fund”

These words will serve as daily reminders of what you’re working for.

50 Money Affirmations for Your Money Vision Board

Adding money affirmations to your money vision board can keep you motivated and focused on your financial goals. These affirmations help shift your mindset and reinforce positive financial habits. Here are 50 powerful money affirmations to inspire you:

Money Mindset Affirmations

- I am worthy of financial success.

- Money flows easily into my life.

- I attract wealth and abundance every day.

- I deserve to be financially free.

- I am in control of my financial future.

- I have the power to create wealth.

- I am open to receiving unexpected financial blessings.

- My financial success is inevitable.

- I am confident in my ability to make smart financial decisions.

- I welcome new streams of income.

Savings and Wealth Building Affirmations

- Every dollar I save brings me closer to financial freedom.

- My savings grow bigger every day.

- I make smart choices that grow my wealth.

- I am building a strong financial foundation.

- My money works for me even when I sleep.

- I easily meet my savings goals.

- I always have enough money to cover my needs and more.

- I am a magnet for financial opportunities.

- My net worth increases every month.

- I am creating lasting wealth for myself and my family.

Debt-Free and Financial Freedom Affirmations

- I am in control of my money, and I release all financial stress.

- I pay off my debts with ease.

- I am free from financial burdens.

- Every dollar I earn helps me reach financial independence.

- I make wise decisions that eliminate debt.

- I am disciplined and committed to living debt-free.

- I let go of any fear about money.

- My financial habits support my long-term wealth.

- I make payments on time and with confidence.

- I am on the path to financial freedom.

Earning More Money Affirmations

- My income is always increasing.

- I create new opportunities to grow my wealth.

- I am capable of earning more than ever before.

- I attract high-paying opportunities.

- I use my skills and talents to generate more income.

- Every day, I take steps toward a more prosperous future.

- My financial success is limitless.

- I am confident in negotiating for higher pay.

- I am worthy of financial abundance.

- I attract clients, customers, and business opportunities with ease.

Money and Gratitude Affirmations

- I am grateful for the money I have and the money that’s on its way.

- I appreciate the abundance that surrounds me.

- I am thankful for every financial lesson I have learned.

- I find joy in managing my money well.

- I use my money to create a happy and secure future.

- I am grateful for every opportunity to grow my wealth.

- I trust that the universe provides for all my financial needs.

- I give and receive money with ease and joy.

- I celebrate every financial win, big or small.

- I am financially secure, and my future is bright.

Adding a few of these affirmations to your money vision board can keep you focused on your goals and remind you to maintain a positive money mindset. Choose the ones that resonate most with you, and repeat them daily to stay motivated!

Placing Your Board Somewhere Visible

Don’t make the mistake of creating a vision board and then tucking it away in a closet. The whole point of a money vision board is to keep your goals front and center. Place it somewhere you’ll see it daily—whether that’s in your bedroom, your office, or even in the kitchen. You want to make sure that you’re constantly reminded of what you’re working toward. It’s easy to lose sight of your goals when life gets busy, but having a visual reminder helps keep you focused.

Reviewing and Updating Your Board

Your financial goals will likely change over time, so it’s important to review your money vision board regularly. Maybe you’ve paid off one debt and need to shift focus to another. Or perhaps you’ve met a short-term goal and are ready to tackle something bigger. Updating your board keeps it relevant and exciting. You don’t want it to become stale or outdated because then it loses its power.

- Tips for reviewing your board:

- Set a reminder to look over your board every couple of months.

- Take time to reflect on your progress and celebrate any wins, no matter how small.

- Remove or replace visuals and words as you achieve goals or adjust them.

Making Your Money Vision Board Work for You

While having a vision board is helpful, it’s not magic. You still need to put in the work to make your financial goals happen. The board is just a tool to keep you motivated and focused, but the real change comes from you and your actions. If you don’t follow through, the vision board won’t do much for you.

To make sure you’re staying on track:

- Set monthly check-ins: Look at your finances and your board to see how close you are to meeting your goals.

- Celebrate small wins: It’s important to acknowledge progress, even if you’re not there yet. Paid off a small debt? Awesome! Added $500 to your savings? Celebrate that too!

- Stay flexible: Life happens, and sometimes you need to adjust your goals. That’s okay. The key is not to give up.

Creative Ideas to Make Your Money Vision Board Stand Out

A money vision board should do more than just sit there looking nice. It needs to grab your attention every day. The more personal and interactive it is, the more it will keep you focused on your financial goals. Here are some creative ways to make your money vision board work for you:

- Add a Savings Tracker – Print out a visual tracker and pin it to your board. Whether it’s a thermometer you color in or a chart with milestones, seeing progress will keep you motivated.

- Use Actual Money – Tape a $1 bill or some spare change onto your board as a daily reminder to save more. If you’re focusing on debt, pin up a cut-up credit card as motivation to stay on track.

- Include Goal Dates – Don’t just add pictures—write down the date you want to achieve each goal. A deadline makes it feel more real and pushes you to stay focused.

- Make a Mini Version – If space is an issue, create a small version of your money vision board in a planner or notebook. A mini board can still be powerful and keep you accountable.

- Create a Digital Vision Board – If you’re more tech-savvy, try making a digital money vision board on Canva or Pinterest. Set it as your phone wallpaper so you see it daily.

By making your board fun and interactive, you’ll be reminded of your goals every day. The more effort you put into making it personal, the more it will inspire you to stick to your financial plan.

How to Use Your Money Vision Board Every Day

It’s easy to create a money vision board and forget about it after a week. The key to success is making it a daily habit. Here are some simple ways to keep your board working for you:

- Look at it every morning – Before starting your day, take a moment to look at your board. Remind yourself why you’re saving, budgeting, or paying off debt.

- Say your goals out loud – Speaking your financial goals makes them feel more real. Saying, “I am saving $5,000 for a vacation,” reinforces your plan.

- Update it regularly – A stale board loses its power. Swap out pictures, add new goals, or remove things you’ve already achieved. Keeping it fresh keeps you motivated.

- Set reminders – If you tend to forget about it, set a daily phone reminder to check your board. Even a quick glance can help keep you focused.

- Use it for decision-making – Before making a big purchase, ask yourself, “Does this help me reach a goal on my money vision board?” If not, it might be worth skipping.

- Celebrate progress – When you hit a milestone, add a gold star or checkmark. Recognizing small wins makes the bigger goals feel more achievable.

Your money vision board isn’t just a decoration—it’s a tool. The more you interact with it, the more powerful it becomes. Use it daily, and watch how it transforms your mindset and spending habits.

How to Involve Your Family in a Money Vision Board

If you have a family, getting everyone on board with financial goals can be a challenge. A money vision board is a great way to make it a team effort. When everyone sees the goals in front of them, they’re more likely to stay on track.

Ideas for getting your family involved:

- Make it a group project – Set aside time for the whole family to create the board together. Let each person pick one financial goal to include.

- Add family-friendly visuals – If you’re saving for a family trip, include pictures of your dream destination. If you’re working on an emergency fund, add a safety net image to explain why it matters.

- Use kid-friendly goal trackers – If your kids are helping save for something special, make a fun progress chart they can color in as you get closer to the goal.

- Give everyone a say – Even young kids can help cut out pictures or suggest ideas. When they feel involved, they’re more likely to support the family’s money goals.

- Tie goals to family rewards – When you hit a savings goal, celebrate with a fun (but budget-friendly) family activity, like a game night or movie at home.

A money vision board doesn’t have to be just for you. When your whole family sees what they’re working toward, it’s easier to make smart financial choices together. Plus, it’s a great way to teach kids about money in a way they can understand.

Common Money Vision Board Mistakes to Avoid

When making a vision board, there are a few common mistakes people make. Avoid these to ensure your board stays powerful:

- Being too vague: If your goals are unclear, you’ll have a harder time achieving them. Be as specific as possible when setting your financial goals.

- Neglecting action steps: Your vision board should include visuals that inspire action. If all you’ve got are pictures of things you want, but no action plan, you’re missing a key element.

- Not updating it: As mentioned earlier, make sure you’re regularly updating your board to reflect your current goals.

A money vision board is more than a collage of pretty pictures—it’s a powerful tool to help you reach your financial goals. Keep it simple, stay focused, and take action. With time, you’ll start seeing those pictures turn into reality.

Final Thoughts

A money vision board isn’t just about pasting pictures on a board—it’s a tool to help you stay focused on your financial goals. When you see your goals every day, you’re more likely to stick with them. Whether you want to save for a big purchase, pay off debt, or grow your wealth, a money vision board can help keep you on track.

Here’s what we covered in this post:

- Why a money vision board works – Visualizing your financial goals makes them feel more real, keeping you motivated.

- How to set the right goals – Whether it’s a short-term savings target or a long-term dream like homeownership, getting specific is key.

- What to put on your board – Pictures, words, and even interactive elements like savings trackers make your board more effective.

- How to use it daily – A vision board only works if you look at it regularly. Keeping it somewhere visible and updating it often makes a difference.

- Ways to get creative – From making a digital version on Pinterest to turning it into a family project, there are so many ways to personalize your board.

A money vision board is more than a craft—it’s a way to bring your financial dreams to life. The more you engage with it, the more powerful it becomes. Keep it fresh, stay focused, and take action on what’s on your board.

If you haven’t made yours yet, now is the time! Gather your supplies, get clear on your goals, and start building a board that helps you stay on track with your money.