Saving for a house can feel like a big mountain to climb. It might seem like every time you get close, some unexpected expense pops up and pushes you back down the hill. It’s frustrating, right? But with the right mindset and small, manageable goals, that big goal starts to look less intimidating. I know how overwhelming it can be to figure out where to even start when you’ve got bills, groceries, and maybe even a few kids depending on you. I’ve been there too.

The first step is realizing it doesn’t have to happen all at once. You don’t need to save every penny of that down payment right this second. It is all about making small changes over time and finding little ways to save that really add up later. And let me tell you, it’s easier than it looks once you get started.

This site includes affiliate links; you can check the disclosure for more details.

Small Steps That Make a Big Difference

When you start saving for a house, it’s all about setting up little wins for yourself. If you’re like me, it can be hard to get motivated by something that feels so far away. That’s why breaking your goal into smaller milestones can make a big difference.

Here’s a simple way to begin:

- Set up a separate savings account just for your house fund. Keeping it separate can help you avoid the temptation to dip into it for other things.

- Automate a portion of your income into that savings account every payday. Even if it’s only a small amount, it adds up faster than you think.

- Start looking at your daily spending habits. Do you really need that extra coffee every day? Cutting out small luxuries for a short while can help you stay on track.

These small actions help build momentum. Before you know it, you’ll look at your account and be surprised at how much money you’ve saved.

Finding the Balance Between Saving and Living

One of the hardest parts of saving for a house is finding that balance. Life is expensive. And let’s be real — you don’t want to sacrifice everything just to save a few extra dollars. The trick is to strike a balance between cutting back where you can while still enjoying life.

Here’s how I manage to keep my savings on track without feeling deprived:

- Meal planning: Eating out adds up. Cooking at home saves more than you think. Plus, you can have leftovers for lunch, cutting down on the temptation to grab something quick (and expensive) during the workday.

- Entertainment budget: Instead of cutting out all fun activities, I set aside a certain amount each month. This way, I can still enjoy movie nights, outings with the kids, or even a nice dinner without feeling guilty. The key is planning ahead.

- Reviewing monthly subscriptions: Take a good look at all the automatic payments leaving your account. Do you really need all of them? Canceling a couple of streaming services or gym memberships you don’t use often can free up a decent chunk of change for your savings.

Cutting Unnecessary Expenses Without Feeling the Pinch

I’ve found that many small expenses slip through the cracks, unnoticed. You don’t even realize how much you’re spending on little things until you take the time to sit down and really track it. When you do, the savings opportunities practically jump off the page.

Here are some areas where you might be able to cut back without much effort:

- Impulse buys: Whether it’s a quick snack at the gas station or a cute shirt on sale, these things add up. Before making a purchase, ask yourself, “Do I really need this right now?” Most of the time, the answer is no.

- Unused memberships: I mentioned it before, but this one is huge. Gym memberships, subscription boxes, apps—are you using them all? If not, cancel them and put that money into your house fund instead.

- Energy use: Simple things like turning off lights when you leave a room, unplugging devices when not in use, or using energy-efficient bulbs can reduce your monthly bills, leaving you with more to save.

It’s all about being mindful. Once you start paying attention to where your money is going, you’ll spot the areas where you can tighten up without feeling the squeeze.

Setting Realistic Savings Goals

It’s easy to get discouraged when your goal feels far away. That’s why setting realistic, achievable goals is so important when saving for a house. Start by figuring out exactly how much you need for a down payment. Then, break that big number into smaller, manageable chunks.

Let’s say your goal is to save $30,000 for a down payment. Instead of focusing on that huge number, break it down:

- If you want to save $30,000 in three years, that’s about $833 a month.

- Can’t manage that right now? No problem. Start smaller. Save $200 a month for now, and look for ways to increase it later. It might take a little longer, but progress is progress.

Having these smaller goals makes the process feel less daunting. And once you hit each milestone, it’s motivating to see how far you’ve come.

Side Hustles That Can Boost Your House Fund

If you’re looking to speed up your savings, side hustles can be a great way to boost your house fund without sacrificing too much of your current lifestyle. I know the idea of taking on extra work can feel exhausting, especially if you’re already juggling a lot, but it doesn’t have to be overwhelming.

Here are a few side gigs you can do on your own time:

- Freelancing: Are you good at writing, graphic design, or social media management? Websites like Upwork or Fiverr make it easy to find freelance gigs.

- Sell unused items: Go through your house and find things you no longer need or use. Sell them on Facebook Marketplace, eBay, or even have a garage sale.

- Babysitting or pet sitting: If you love kids or animals, offering these services in your community can bring in some extra cash on the weekends.

Even if you only make an extra $100 or $200 a month, it’s something you can put directly toward your house fund. Over time, it really makes a difference.

How to Stay Motivated When Saving for a House

Staying motivated when saving for a house can be tough, especially when it feels like there’s always something tempting you to spend. For me, visual reminders work wonders. Having a clear picture of what I’m working toward helps keep me focused.

Here are a few ways to stay motivated:

- Vision board: Create a board with pictures of the type of house you want. It doesn’t have to be fancy; even cutting out magazine clippings can work. Stick it somewhere you’ll see it every day.

- Savings tracker: You can use a simple chart where you color in each milestone as you reach it. Watching your progress in real-time is satisfying.

- Reward yourself: When you hit a savings milestone, treat yourself to something small. Whether it’s a fancy coffee or a new book, these little rewards make the process feel more enjoyable.

Saving for a house is a long journey, but keeping your eye on the prize helps. Every dollar you save gets you one step closer to unlocking that front door.

How to Save for a House When You Feel Like You Have No Extra Money

I get it—sometimes it feels like there’s just no extra money left at the end of the month. But saving for a house doesn’t mean you need a big paycheck or a huge lifestyle change. It’s about finding those little money leaks and making smart choices that add up.

Here’s how I make it work even when money feels tight:

- Round-up savings apps – Apps like Acorns or Chime automatically round up your purchases and save the spare change. It’s small, but over time, those pennies add up.

- Pay yourself first – Before you pay bills or shop, transfer a set amount (even $10) into your house fund. Treat it like a bill you can’t skip.

- Cut back on subscriptions – I took a hard look at my subscriptions. Did I really need four streaming services? Nope. Canceling just one freed up an extra $15 a month.

- Sell what you don’t use – I cleaned out my closet and found clothes, old gadgets, and even kitchen tools I never used. Selling them online gave my savings account a nice boost.

- Plan no-spend weekends – Instead of spending money on entertainment, I started planning free fun—hiking, library trips, or game nights. Even skipping one dinner out per month saved me $50.

It all comes down to being mindful. Once you find small ways to save, your house fund starts growing before you even realize it. And let me tell you, watching that account balance go up is incredibly motivating!

How to Cut Hidden Expenses and Save for a House Faster

Some expenses are obvious, like rent or groceries. But hidden expenses? They’re sneaky. They slowly drain your money before you even notice. When I started looking for ways to save for a house, I realized I had a bunch of these little money traps.

Here are some ways I cut back without missing a thing:

- Bank fees – I switched to a no-fee bank account. No more monthly charges, overdraft fees, or ATM withdrawal costs.

- Unused memberships – That gym I “planned” to go to? Gone. The premium music service? Switched to the free version. Cutting these out saved me $40 a month.

- Impulse buys – I set a 24-hour rule. If I see something I want, I wait a day. Most of the time, I realize I don’t need it.

- Energy bills – I started unplugging devices, turning off lights, and adjusting the thermostat. My electricity bill dropped by $30.

- Grocery spending – I started meal planning and stopped buying random snacks. I also switched to store-brand items. That saved me at least $50 a month.

Finding these hidden costs and cutting them made saving for a house so much easier. Once I saw how much money I was keeping, I got serious about making every dollar count.

Unexpected Ways to Boost Your Savings for a House

Sometimes, saving for a house takes more than just cutting back. Finding extra ways to bring in money can speed things up in a big way. I was surprised at how many small side gigs and creative ideas could help.

Here are a few unexpected ways to grow that house fund faster:

- Cash-back apps – I use Rakuten and Ibotta to get money back on things I was buying anyway. It’s like free savings!

- Rent out stuff – I rented out a spare room on Airbnb, but even renting out things like baby gear, tools, or cameras can bring in extra cash.

- Turn a hobby into income – I started selling homemade crafts online. If you bake, knit, or do graphic design, there’s money to be made.

- Online surveys and focus groups – They won’t make you rich, but some pay $5 to $50 just for sharing your opinion.

- Sell unwanted gift cards – I had old gift cards I knew I’d never use. I sold them online and put the cash into my savings.

- Round up spare change – Some banks let you round up purchases and save the difference. Every little bit helps!

Getting creative with extra income made saving for a house less stressful. It doesn’t have to be big, just steady. Seeing those extra dollars add up makes the whole process feel real—and exciting!

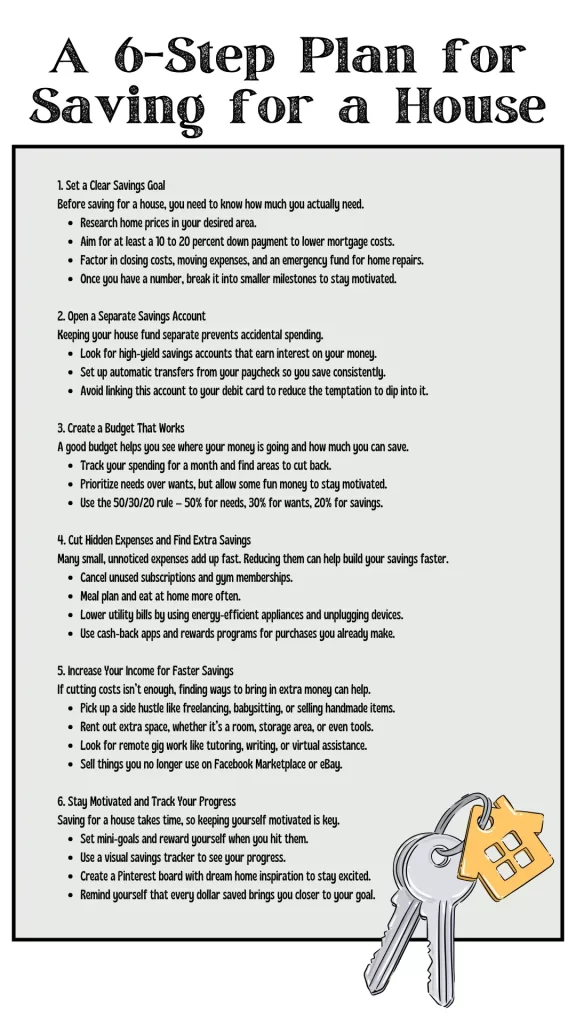

A 6-Step Plan for Saving for a House

Saving for a house doesn’t have to feel impossible. Breaking it into clear steps makes it much easier to tackle. Here’s a simple six-step plan to help you build your house fund without feeling overwhelmed.

1. Set a Clear Savings Goal

Before saving for a house, you need to know how much you actually need.

- Research home prices in your desired area.

- Aim for at least a 10 to 20 percent down payment to lower mortgage costs.

- Factor in closing costs, moving expenses, and an emergency fund for home repairs.

- Once you have a number, break it into smaller milestones to stay motivated.

2. Open a Separate Savings Account

Keeping your house fund separate prevents accidental spending.

- Look for high-yield savings accounts that earn interest on your money.

- Set up automatic transfers from your paycheck so you save consistently.

- Avoid linking this account to your debit card to reduce the temptation to dip into it.

3. Create a Budget That Works

A good budget helps you see where your money is going and how much you can save.

- Track your spending for a month and find areas to cut back.

- Prioritize needs over wants, but allow some fun money to stay motivated.

- Use the 50/30/20 rule – 50% for needs, 30% for wants, 20% for savings.

4. Cut Hidden Expenses and Find Extra Savings

Many small, unnoticed expenses add up fast. Reducing them can help build your savings faster.

- Cancel unused subscriptions and gym memberships.

- Meal plan and eat at home more often.

- Lower utility bills by using energy-efficient appliances and unplugging devices.

- Use cash-back apps and rewards programs for purchases you already make.

5. Increase Your Income for Faster Savings

If cutting costs isn’t enough, finding ways to bring in extra money can help.

- Pick up a side hustle like freelancing, babysitting, or selling handmade items.

- Rent out extra space, whether it’s a room, storage area, or even tools.

- Look for remote gig work like tutoring, writing, or virtual assistance.

- Sell things you no longer use on Facebook Marketplace or eBay.

6. Stay Motivated and Track Your Progress

Saving for a house takes time, so keeping yourself motivated is key.

- Set mini-goals and reward yourself when you hit them.

- Use a visual savings tracker to see your progress.

- Create a Pinterest board with dream home inspiration to stay excited.

- Remind yourself that every dollar saved brings you closer to your goal.

By following these six steps, saving for a house becomes much more manageable. With a solid plan, patience, and smart financial habits, you’ll be unlocking your dream home sooner than you think!

Final Thoughts on Saving for a House

Saving for a house might seem overwhelming at first, but small, consistent steps make a big difference. The trick is to find simple ways to save without making life miserable. Cutting back on unnecessary expenses, setting up a dedicated savings account, and looking for extra income streams can help build your house fund faster.

Here’s what we covered:

- Small changes add up – Rounding up purchases, cutting subscriptions, and planning no-spend weekends can free up extra cash.

- Hidden expenses are sneaky – Bank fees, impulse buys, and high energy bills can quietly drain your money. Fixing these puts more in your savings.

- Side income helps speed things up – Renting out items, using cash-back apps, or selling things you don’t need can add unexpected money to your house fund.

- Balance is key – Saving doesn’t mean giving up everything. Budgeting for fun while being mindful of spending makes the process sustainable.

It’s easy to feel discouraged, but tracking progress keeps you motivated. I love using visual savings trackers or even Pinterest boards filled with dream home inspiration. Seeing those small wins adds up to something big over time.

Saving for a house is all about being intentional. Every dollar saved gets you closer to your goal. Stay consistent, celebrate progress, and keep your eyes on the prize. Before you know it, you’ll be turning that house fund into a set of keys in your hand!