Many of us have goals we want to reach. Whether it’s building an emergency fund, saving for a dream vacation, or just feeling more in control of our money, it all takes planning. But let’s face it, saving can feel overwhelming. That’s where a savings challenge comes in. It breaks things down into smaller steps and helps make saving more fun and achievable.

A savings challenge isn’t just for big financial goals. It can help with everyday expenses, too. No matter your income, this can be a helpful way to manage your money better.

This site includes affiliate links; you can check the disclosure for more details.

What is a Savings Challenge?

A savings challenge is a simple, structured way to save money over a set period. Think of it as a personal competition where you set a goal, follow a plan, and try to hit your target. You can make it fun by using trackers, jars, or apps to visualize your progress.

Here are a few types of savings challenges you can try:

- The 52-week challenge: Save a set amount each week, starting with $1 the first week and adding another dollar each week. By the end of the year, you’ll have saved $1,378.

- The $5 challenge: Every time you get a $5 bill, put it aside. It adds up quicker than you think.

- The no-spend challenge: Choose a category like coffee or takeout and avoid spending in that area for a week or a month. Put the money you’d normally spend into savings.

Each of these options offers a clear and simple path to boost your savings over time.

How to Choose the Right Challenge for You

Not all savings challenges will fit your lifestyle. It’s important to choose one that works with your budget, goals, and habits. Otherwise, you might give up halfway through. Think about what you’re trying to accomplish and how much flexibility you need.

Here are some tips to get started:

- Start small: Don’t overwhelm yourself. If saving $50 a week feels too hard, start with $5 or $10.

- Pick a time frame that works for you: Some people prefer shorter challenges, like a month, while others thrive on long-term ones, like the 52-week challenge.

- Make it visible: Use a calendar, app, or even a chart on your fridge to track your progress. Seeing the savings grow can be motivating.

- Be flexible: Life happens, and that’s okay. If you miss a week, don’t stress. Just get back on track the next week.

The $1 Weekly Savings Challenge: Watch Your Savings Grow Fast

If saving money feels overwhelming, the $1 weekly savings challenge is a simple way to start. It’s easy, flexible, and helps build your savings without stress. The best part? You don’t need a huge budget to make it work.

How It Works

This challenge follows a simple pattern:

- Week 1: Save $1

- Week 2: Save $2

- Week 3: Save $3

- Week 4: Save $4

Each week, you add another dollar to the amount you save. By the end of the year, you’ll have saved $1,378 without making any big sacrifices.

Why It Works

- It starts small – Saving just a few dollars in the beginning makes it easy to stick with.

- It builds momentum – As the savings grow, you get motivated to keep going.

- It fits any budget – Even if money is tight, adding a dollar each week is manageable.

- It adds up fast – You might not feel the difference week to week, but by the end, you’ll have a solid amount saved.

Tips for Success

- Go digital: Set up an automatic transfer each week to a savings account.

- Track your progress: Use a savings app or a printable chart to stay motivated.

- Start backward: If saving more at the end of the year is tough, flip the challenge. Start with $52 and work your way down.

- Pair it with extra savings: Rounding up your purchases or skipping small splurges can help add more to your total.

This savings challenge is an easy way to build a habit of saving while watching your money grow each week.

The $2 Weekly Savings Challenge: Double Your Savings with Ease

If you want to save even more without making drastic changes to your budget, the $2 weekly savings challenge is a great option. It works just like the $1 version but doubles the weekly amount. By the end of the year, you’ll have saved $2,756—twice as much as the $1 challenge!

How It Works

Each week, you increase the amount you save by $2:

- Week 1: Save $2

- Week 2: Save $4

- Week 3: Save $6

- Week 4: Save $8

By week 52, you’ll be setting aside $104 in one week. It may seem like a lot, but since you build up gradually, it’s easier to manage.

Why It Works

- More savings in the same time – You reach a bigger goal without stretching your budget too much.

- Gradual increase – The small weekly increases make it feel more doable.

- Good for bigger goals – If you’re saving for a vacation, home project, or emergency fund, this is a great way to get there faster.

Tips for Success

- Use an automatic transfer: Set up a recurring transfer in your bank to move the correct amount each week.

- Track progress visually: Use a savings app, chart, or spreadsheet to keep yourself motivated.

- Start with larger amounts first: If you think the later weeks will be tough, flip the challenge and start at $104, working your way down.

- Combine it with small cutbacks: Skip a few unnecessary purchases, and you’ll hardly feel the difference in your budget.

This savings challenge is an excellent way to push yourself to save more without feeling overwhelmed. You’ll be amazed at how quickly your savings grow with just a little consistency!

The Simple $5,000 Weekly Savings Challenge: One Fixed Amount, No Guesswork

Saving $5,000 in a year doesn’t have to be complicated. If you prefer a simple, no-fuss method, this weekly savings challenge keeps things easy—just save the same amount each week.

How It Works

With this plan, you save $97 every week for 52 weeks. No increasing amounts, no tracking changes—just a consistent weekly habit.

- Week 1: Save $97

- Week 2: Save $97

- Week 3: Save $97

- Week 52: Save $97

At the end of the year, you’ll have $5,044 saved, hitting your goal with a simple, steady approach.

Why This Challenge Works

- Easy to Follow – No increases or complex tracking, just one amount each week.

- Great for Budgeting – Knowing exactly how much to set aside helps with planning.

- Less Stress – A steady savings amount means no surprise high weeks later in the challenge.

- Perfect for Any Goal – Whether you’re saving for a trip, emergency fund, or a big purchase, this method keeps things simple.

Tips to Stay on Track

- Automate your savings – Set up a weekly transfer to a separate savings account.

- Use a visual tracker – A chart or app helps keep motivation high.

- Plan ahead – If a week is tight, adjust your spending to stay consistent.

- Treat it like a bill – Prioritize this deposit just like any other must-pay expense.

With this simple and structured plan, you’ll save $5,044 in just 52 weeks—without the hassle of tracking different amounts. A year from now, your savings will be right where you want them!

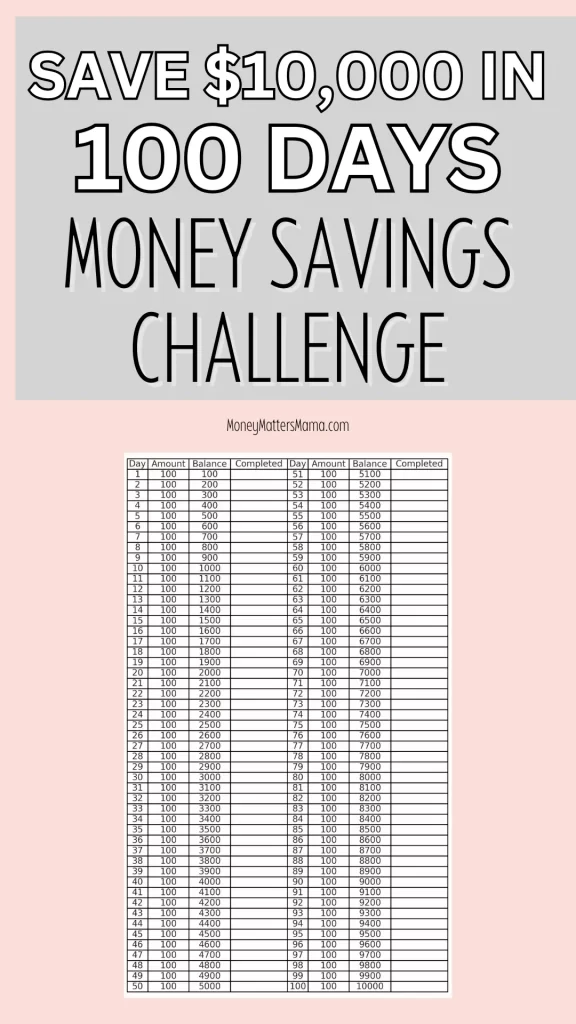

The 100-Day $10,000 Savings Challenge: A Fast-Track Plan to Big Savings

If you need to save a large amount quickly, the 100-day $10,000 savings challenge is a great option. Instead of spreading savings over a year, this plan helps you reach your goal in just over three months. It’s a focused approach that requires commitment but delivers big results.

How It Works

This challenge is simple:

- Save $100 per day for 100 days to reach $10,000.

- Use a saving tracker or a money chart to monitor your progress.

- Adjust daily contributions if needed—some people save a little more on high-income days and less on tighter days.

Why This Challenge Works

- Fast results – Instead of waiting a year, you’ll reach $10,000 in just over three months.

- Structured plan – A clear, daily goal makes it easy to stay on track.

- Great for short-term goals – Whether saving for a down payment, an emergency fund, or a major expense, this method helps you get there quickly.

Tips to Stay on Track

- Automate your savings – Set up daily or weekly transfers to a dedicated account.

- Cut unnecessary expenses – Skip non-essentials and redirect that money toward your goal.

- Use extra income – Bonuses, tax refunds, or side hustle earnings can help speed up the process.

- Track progress visually – A savings chart or app can keep you motivated.

If you’re looking for a fast way to save, this money saving challenge is one of the most effective money saving techniques out there. Stick with the plan, and in just 100 days, you’ll have $10,000 saved!

How a Savings Challenge Can Change Your Mindset

It’s easy to think of saving money as something stressful. But a savings challenge can turn it into something exciting. You’re giving yourself a clear path forward, and each milestone you hit feels like a win. It helps to change the way you think about saving and makes it feel less like a burden and more like a goal you’re actively reaching.

Here’s what happens when you start a savings challenge:

- You develop good habits: Saving a little bit each week becomes second nature. Over time, it’s easier to set money aside without overthinking it.

- You see progress: Watching your savings grow week by week keeps you motivated to continue.

- You learn discipline: A savings challenge gives you structure. You stick to a plan, and in doing so, you develop discipline that can carry over into other areas of your life.

These are just some of the mindset shifts that can happen when you take on a savings challenge. Over time, saving money feels less like a chore and more like a part of your routine.

Making Your Challenge Personal

There’s no one-size-fits-all when it comes to savings. You might need to tweak the rules to fit your lifestyle. Maybe the weekly savings amount feels too high, or perhaps you get paid bi-weekly and need to adjust the timing. Whatever the case, it’s okay to make the challenge your own. The important part is sticking to it.

You could also add a reward system to keep yourself motivated. Maybe every month that you hit your goal, you treat yourself to something small, like a book or a movie night. These little rewards can help you stay focused on the bigger goal.

How to Do a Savings Challenge in a Cashless Society

With the rise of digital payments, many of us rarely use cash anymore. But that doesn’t mean you can’t take on a savings challenge. You can easily adapt it to fit the cashless world we live in today. In fact, digital tools can make tracking your progress even easier.

Here’s how to get started with a savings challenge in a cashless society:

- Use a separate savings account: Open a dedicated account just for your challenge. Each time you meet your savings goal, transfer the amount digitally into that account. It keeps your challenge funds separate and helps you resist the temptation to spend them.

- Automate your savings: Most banks allow you to set up automatic transfers. You can schedule transfers that align with your challenge—weekly, biweekly, or monthly. It takes the pressure off having to remember and ensures you stick to the plan.

- Track your progress with an app: Use a budgeting or savings app to log your progress. Some apps even have built-in savings challenges, making it easy to follow along. You can also create your own tracker to monitor how close you are to hitting your goal.

- Use digital envelopes: If you’re familiar with the envelope system for budgeting, you can still do this digitally. Many banking apps allow you to create separate “buckets” or goals within one account, so you can divide your savings challenge money from your other funds.

- Keep a visual reminder: Even though your savings are digital, you can still keep a visual representation of your progress. Use a simple chart or jar graphic that you color in as you reach each milestone. Seeing your progress in a tangible way can keep you motivated.

By adapting your savings challenge to work digitally, you can make the most of the cashless world. You’ll find that it’s still just as satisfying to watch your savings grow—whether it’s through physical cash or digital transfers.

Staying Motivated When It Gets Tough

Let’s be real, sticking to a savings challenge can be hard sometimes. Life is unpredictable, and you might find yourself tempted to spend the money you’ve been setting aside. The key is to remind yourself why you’re doing this in the first place.

Here are some ways to stay motivated:

- Focus on your goal: Whether it’s saving for a rainy day or something special, keep your eyes on the prize. You’re building something that will benefit you in the long run.

- Involve others: Sometimes sharing your challenge with a friend or family member can make it more fun. You can cheer each other on and hold each other accountable.

- Break it up: If the full challenge seems too long, break it into smaller chunks. Focus on the next month, not the whole year.

- Celebrate your wins: No matter how small the milestone, celebrate it. You’re making progress, and that’s worth acknowledging.

The Benefits of Completing a Savings Challenge

When you complete a savings challenge, you don’t just end up with more money in the bank—you gain something more. You’ve proven to yourself that you can set a goal and reach it. That’s huge. It gives you confidence in your ability to manage your money.

There are many benefits to completing a challenge:

- You build an emergency fund: Life is unpredictable, and having a cushion gives you peace of mind.

- You gain more control over your finances: Instead of wondering where your money went, you’ll know exactly what you’ve saved.

- You reduce stress: Knowing you’re prepared for unexpected expenses can lower the financial stress in your life.

- You learn what works for you: By the end, you’ll have a better idea of what saving strategies fit your lifestyle.

A savings challenge might seem like a small step, but it can make a big impact. Not only on your wallet but on your mindset.

What Happens After the Challenge?

After you’ve completed a savings challenge, don’t stop. Now that you’ve built up some savings, it’s a great time to re-evaluate your financial goals. Maybe you want to start investing or work toward paying off debt. Or, you might set a new savings goal.

Here are some ideas for what to do next:

- Continue saving: If the challenge worked for you, keep going. Maybe try another challenge, like increasing the weekly amount or extending the time.

- Use your savings wisely: Whether you put it into a high-yield savings account or use it for a specific goal, make sure the money you’ve saved works for you.

- Start a budget: Now that you have a habit of saving, you might find it easier to create and stick to a budget.

No matter what you do next, you’ve already laid the foundation for better financial habits.

Final Thoughts

A savings challenge is one of the easiest ways to build better money habits. It gives you a clear plan, keeps you motivated, and helps you reach your financial goals faster. Instead of wondering where your money went, you’ll see real progress week after week.

We covered several types of savings challenges, so there’s something for everyone:

- The $1 Weekly Savings Challenge starts small and builds gradually, reaching $1,378 by the end of the year.

- The $2 Weekly Savings Challenge doubles that, helping you save $2,756 in 52 weeks.

- A fixed $97 per week challenge keeps it simple, bringing in $5,044 by the end of the year.

No matter which one you choose, sticking with it is the key.

Here’s how to make it easier:

- Automate savings – Set up weekly transfers so you don’t have to think about it.

- Use a tracker – Whether it’s a printable chart, an app, or even Pinterest for inspiration, seeing progress keeps you motivated.

- Plan ahead – If later weeks require more savings, adjust spending early to make room.

A year from now, you’ll be glad you started. Even if you modify the challenge to fit your budget, the important part is building the habit. Every small step adds up, and by the end, you’ll have a solid savings fund—and proof that you can stick to a goal.